Navigating the Investment Landscape in 2024: Insights from the UBS House View Report

- Alpesh Patel

- Feb 15, 2024

- 2 min read

As we step into 2024, the investment horizon is marked by a blend of opportunities and challenges, shaped by economic uncertainties, technological advancements, and geopolitical dynamics. The "Outlook 2024 – UBS House View" report offers a comprehensive analysis of the equities market, providing investors with critical insights to navigate these complex times. Here are the top 10 takeaways from the report:

Prioritize Quality Investments: In an era where economic uncertainty and rapid technological change are the norms, the report emphasizes the importance of focusing on quality investments. High-quality bonds and stocks, particularly in the technology sector, are recommended for their resilience and growth potential.

Adapting to Economic Shifts: The global economy is experiencing slower growth, notably in major economies such as the US, Europe, and China. Investors are advised to adapt their strategies to these changing economic conditions to safeguard their portfolios.

Embrace Technological Disruption: The technology, energy, and healthcare sectors are at the forefront of transformation. Investing in these areas can offer substantial returns as they adapt and evolve in response to new challenges and opportunities.

Geopolitical Influences on Markets: The report highlights the significant impact of political events, including the US presidential election and ongoing international conflicts, on market dynamics. Investors should remain vigilant and responsive to these geopolitical shifts.

Central Banks' Role in the Economy: With central banks expected to start cutting rates in 2024, there will be a notable influence on bond markets and yields. This strategic shift requires investors to stay informed and adjust their bond strategies accordingly.

Decarbonization Opportunities: Climate change and national security concerns are accelerating investments in decarbonization technologies. These initiatives not only address environmental and security issues but also offer promising growth prospects for investors.

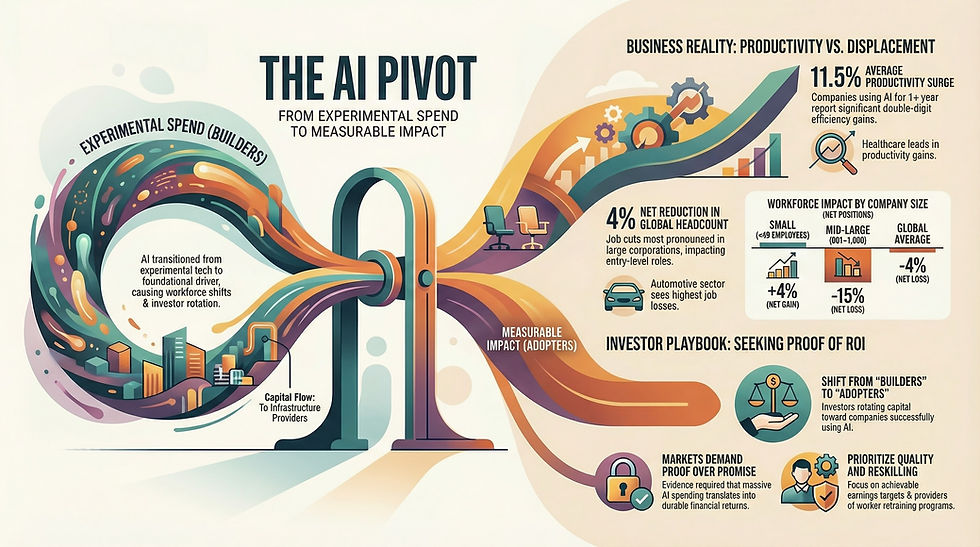

AI's Market Impact: The advent of generative AI is set to revolutionize various sectors, creating new value and investment opportunities. The report suggests that AI's influence will be widespread, benefiting those who invest early in its potential.

Diversify with Alternative Credit: In a landscape characterized by high debt levels, alternative credit, including private credit, emerges as a valuable diversification tool, offering varied investment opportunities.

Effective Liquidity Management: As interest rates decline, managing liquidity becomes crucial. Optimizing investment yields through effective liquidity management strategies is recommended to enhance portfolio performance.

Emerging Market Potential: The report identifies emerging markets, especially in Asia, as fertile ground for investment. These regions present unique opportunities aligned with their evolving growth models, offering investors a chance to diversify and capitalize on new growth avenues.

In conclusion, the "Outlook 2024 – UBS House View" report provides a roadmap for investors navigating the complexities of the current investment landscape.

By focusing on quality, adapting to economic and geopolitical changes, and embracing technological advancements, investors can position themselves to capitalize on the opportunities that 2024 and beyond have to offer.

Alpesh Patel OBE

Visit www.alpeshpatel.com/shares for more and see www.alpeshpatel.com/links

Comments