Why Your Pension Is Underperforming: 5 Surprising Truths Most Investors Never See

- Alpesh Patel

- 6 minutes ago

- 6 min read

Updated in January 2026

Why millions of intelligent investors feel uneasy about their pensions and why that instinct is usually right.

Introduction: The Question Most Pension Statements Don’t Answer

For many people with a workplace or personal pension, there’s a quiet but persistent doubt that never really goes away:

“Is my money actually working as hard as it should?”

You receive annual statements. You see percentages. You’re told everything is “on track.”Yet the growth feels slow. Disconnected. Underwhelming.

This discomfort is incredibly common, especially among people in their 40s, 50s and early 60s who are finally close enough to retirement for the numbers to matter. Most assume the issue is market volatility, bad timing, or simply “how pensions work.”

The reality is more uncomfortable and more empowering.

For many investors, poor pension performance is not bad luck. It is the predictable outcome of how the modern pension industry is structured.

If you’d like a concise overview before diving into the full article, watch this video that breaks down the key reasons pensions often underperform:

This article breaks down five surprising truths about why so many pensions underperform and why switching providers often doesn’t fix the problem. Once you understand these structural issues, you move from passive frustration to informed control.

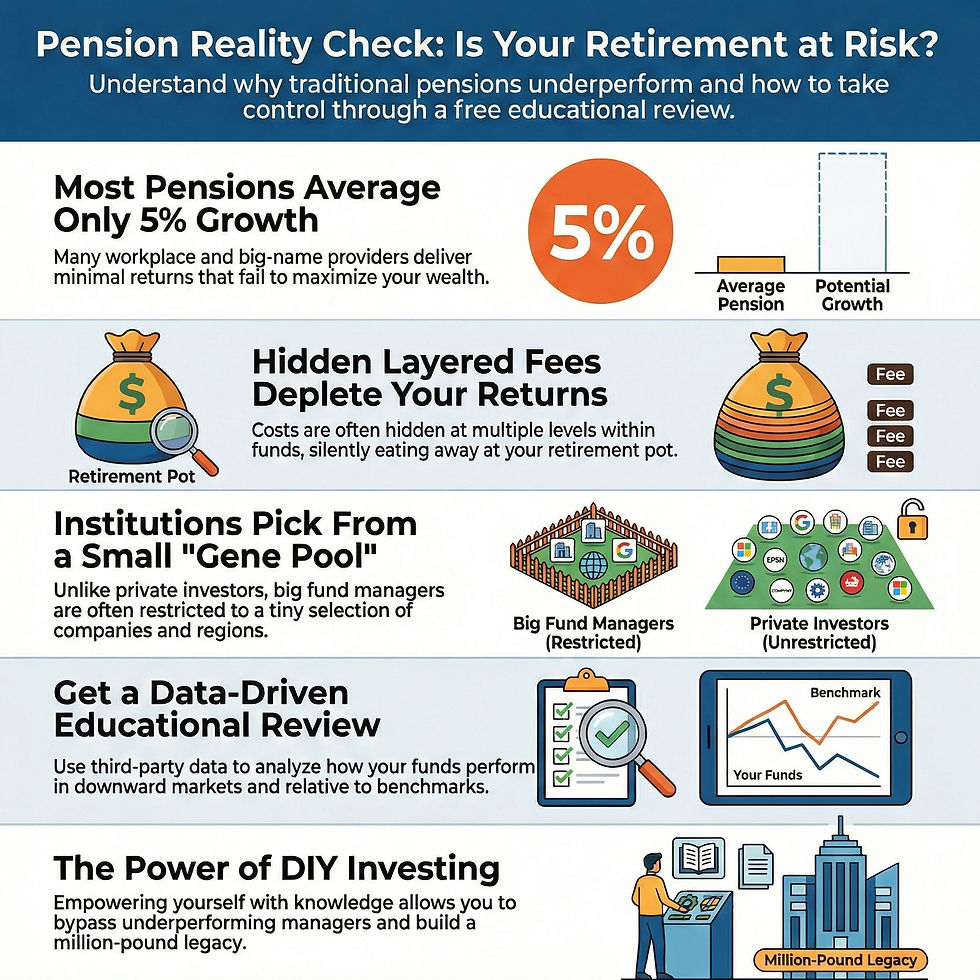

1. The 5% Growth Trap: Why Pension Disappointment Is Normal

One of the biggest reasons people feel uneasy about their pensions is simple — long-term growth is far lower than expected.

Across large sections of the market, many workplace and “big-name” pensions have delivered returns averaging around 5% per year over long periods. Sometimes slightly more. Often less. Frequently after inflation, barely anything at all.

This is not anecdotal. It shows up repeatedly when long-term performance is stripped of marketing language and examined year by year.

At first glance, 5% doesn’t sound disastrous. But over decades, compounding tells a very different story.

At 5%, money roughly doubles every 14–15 years

At 8–10%, the outcome over a working lifetime can be dramatically different

The gap between “acceptable” and “meaningful” growth is enormous — and most pension holders are stuck on the wrong side of it.

Crucially, this problem is not confined to obscure funds. It affects:

Default workplace pensions

Heavily marketed “trusted” providers

Large wealth managers that promise peace of mind but deliver mediocrity

Realising this is important. It reframes the issue.

If your pension feels disappointing, you are not failing as an investor. You are experiencing a system-wide outcome.

2. The Hidden Architecture of Pension Underperformance

Low growth is not accidental. It is engineered — quietly — through the structure of large pooled funds.

Two forces do most of the damage:

Dilution

Layered fees

Both are largely invisible to the end investor, yet both compound relentlessly over time.

3. Dilution: Why Owning “Great Stocks” Doesn’t Help Your Pension

Many investors are reassured when they see recognisable winners listed in their fund’s holdings.

You may notice names like:

Nvidia

Apple

Microsoft

Amazon

The assumption is natural: “If my fund owns these companies, I must be benefiting from their success.”

In reality, this is often an illusion.

The dilution problem works like this:

Large funds typically hold hundreds sometimes thousands of positions. Even when they own a spectacular performer, the allocation is usually tiny.

A stock can rise several hundred percent, yet barely move the overall fund because:

The position size is too small

The gains are drowned out by mediocre or losing holdings

Over-diversification neutralises success

In simple terms:Owning a great stock inside a bad structure doesn’t produce great results.

Worse still, many funds are slow to reduce losing positions during downturns. Instead of protecting capital, they ride declines all the way down — then require years of recovery just to break even.

Dilution creates the appearance of diversification, but often delivers mediocrity by design.

4. Layered Fees: When Charges Compound Against You

Fees are often presented as small, reasonable percentages. What is rarely explained is how many layers exist and how they interact over time.

In many large pension structures, you pay:

A visible top-level fee

Fees inside underlying funds

Transaction costs

Platform and administration charges

Each layer may seem modest in isolation. Together, they form a negative compounding engine.

The key issue is not just cost it is opacity.

You often cannot see:

Which layer is responsible for underperformance

How much growth is lost before it ever reaches your account

Whether the fee structure justifies the outcome

Over 10, 20, or 30 years, layered fees don’t just reduce returns — they reshape your entire retirement outcome.

This is why two portfolios exposed to similar markets can produce radically different results.

5. The “Small Gene Pool” Problem: A Structural Disadvantage

Even if fees were transparent and dilution controlled, most large funds still face a fundamental handicap.

They are structurally restricted.

Fund managers are often limited by:

Geographic mandates

Market-cap requirements

Approved lists

Benchmark constraints

This means they are not free to search the world for the best opportunities. Instead, they are forced to select from a narrow, pre-approved universe.

An analogy makes this clear:

It’s like hiring only from one postcode instead of searching globally for the best talent.

Private investors, by contrast, can:

Look across regions

Focus on conviction rather than box-ticking

Avoid artificial constraints

This difference alone creates a permanent performance gap — regardless of individual manager skill.

6. Why Switching Fund Managers Rarely Solves the Problem

Faced with disappointment, many investors do the logical thing: they switch providers.

Unfortunately, this often leads to the same outcome just with different branding.

Why?

Because most fund managers:

Operate under similar mandates

Face the same career risks

Are benchmark-constrained

Cannot act decisively without institutional permission

In short, changing managers often means changing the label, not the structure.

The real issue is not who manages the money it’s how the system itself is designed.

7. The Real Alternative: Education Over Delegation

At some point, a difficult conclusion emerges:

The solution is not endlessly searching for a better intermediary.

The solution is understanding enough to take control yourself.

This idea unsettles many people. We are taught that investing is complex, risky, and best left to professionals.

Yet history repeatedly shows that:

Knowledge reduces risk

Simplicity often beats complexity

Incentives matter more than credentials

This philosophy is echoed by long-term investors who consistently emphasise education over delegation.

The goal is not speculation. The goal is capability.

8. What a Data-Driven Pension Reality Check Actually Does

Understanding theory is one thing. Seeing your own numbers is another.

A proper pension reality check:

Removes marketing language

Uses publicly available data

Examines true annualised returns

Tests downside protection (e.g. 2022)

Identifies dilution and fee drag

This is not opinion.It is forensic analysis.

Most people discover:

Why growth stalled

Which holdings contributed nothing

Where protection failed

How much compounding was lost

Once seen, the fog lifts.

9. Why This Education Is Free (And Why That Matters)

In a fee-driven industry, free education understandably raises suspicion.

So it’s worth stating clearly:

This is not a sales call.

The objective is education not dependency.

The motivation is simple:

Knowledge compounds without depletion

Education scales without conflict

Empowered investors ask better questions

Projects like Campaign for a Million exist to spread understanding, not extract fees.

Conclusion: The First Step Is Seeing Clearly

If your pension feels underwhelming, that instinct is likely correct.

For millions of investors, underperformance is not caused by markets, timing, or personal mistakes but by:

Structural dilution

Layered fees

Restricted opportunity sets

Institutional incentives

The most powerful step forward is not panic or blind switching.

It is clarity.

Education transforms frustration into control. And control changes outcomes.

Further Reading & Free Educational Resource

For readers who want a data-led breakdown of how pensions actually perform and why the Pension Reality Check: Your Financial X-Ray provides a structured, educational review using public data and stress testing.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Past performance is not a reliable indicator of future results. Always do your own research or seek independent advice before making investment decisions.

Alpesh Patel OBE

Comments