How Have Historical Tariff Announcements Affected the Stock Market

- Alpesh Patel

- Apr 5, 2025

- 3 min read

Historically, tariff announcements have often caused significant volatility in the stock market, as they introduce uncertainty about global trade relationships, corporate earnings, and economic growth. Here are a few notable examples of how past tariff-related events have impacted the markets:

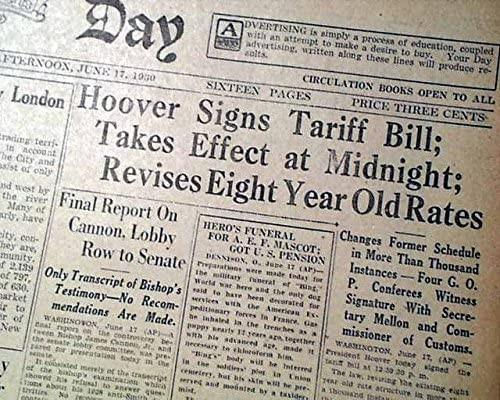

1. Smoot-Hawley Tariff Act (1930)

What Happened: The U.S. imposed high tariffs on over 20,000 imported goods in an effort to protect domestic industries during the Great Depression.

Market Reaction: The act is widely believed to have exacerbated the Great Depression by triggering retaliatory tariffs from other countries, reducing global trade. The stock market continued its downward spiral, with the Dow Jones losing nearly 90% of its value from its 1929 peak by 1932.

2. Steel and Aluminum Tariffs (2018)

What Happened: In March 2018, President Trump announced tariffs of 25% on steel and 10% on aluminum imports.

Market Reaction: The stock market initially dropped sharply due to fears of a trade war but later stabilised. However, specific sectors like manufacturing and agriculture faced prolonged pressure due to higher input costs and retaliatory tariffs from trading partners like China and the EU.

3. U.S.-China Trade War (2018–2019)

What Happened: The U.S. imposed multiple rounds of tariffs on Chinese goods, prompting retaliatory measures from China.

Market Reaction: Markets experienced heightened volatility throughout the trade war. For example:

In May 2019, when additional tariffs were announced, the Dow Jones fell over 600 points in a single day.

Tech stocks were hit particularly hard due to concerns about supply chain disruptions and reduced demand in China.

By late 2019, partial agreements (e.g., "Phase One" deal) helped markets recover.

4. Tariffs on Mexico (2019)

What Happened: President Trump threatened tariffs on Mexican imports unless Mexico took action to curb illegal immigration.

Market Reaction: The Dow fell nearly 1,000 points over several days as investors feared disruptions to North American trade. Markets rebounded after the tariffs were called off following negotiations.

Key Takeaways from Historical Trends

Short-Term Volatility: Markets typically react negatively to tariff announcements due to uncertainty about their economic impact.

Sector-Specific Impacts: Industries reliant on global supply chains—such as technology, manufacturing, and agriculture—are often hit hardest.

Long-Term Effects Depend on Retaliation: If trading partners impose countermeasures, the economic impact can deepen, prolonging market instability.

Safe-Haven Assets Rise: Gold and U.S. Treasury bonds tend to rally during tariff-induced market turmoil as investors seek safer investments.

While historical patterns suggest that markets often recover after initial shocks, prolonged or widespread trade disputes can lead to lasting economic consequences. Investors typically monitor developments closely and adjust portfolios based on perceived risks and opportunities.

RISK WARNING: All investing is risky. Returns at not guaranteed. Past performance and case studies are no guarantee of future results.

Disclaimer: The content provided on this blog is for informational purposes only and does not constitute financial advice. The opinions expressed here are the author's own and do not reflect the views of any associated companies. Investing in financial markets involves risk, including the potential loss of your invested capital. Past performance is not indicative of future results.

You should not invest money that you cannot afford to lose. Mentions of specific securities, investment strategies, or financial products do not constitute an endorsement or recommendation. The author may hold positions in the securities discussed, but these should not be viewed as personalised investment advice.

Readers are encouraged to conduct their own research and seek professional advice before acting on any information provided in this blog. The author is not responsible for any investment decisions made based on the content of this blog.

Alpesh Patel OBE

Visit www.alpeshpatel.com/shares for more and see www.alpeshpatel.com/links

Comments