Should You Ever Move to Cash?

- Alpesh Patel

- Oct 25, 2025

- 4 min read

Why Sensible Investors Still Struggle with Fear and Diversification

A client wrote to me recently, and his email could have been lifted straight from the minds of thousands of thoughtful investors across Britain.

“I joined because I need to improve my pension performance. I understand that doesn’t come without risk. For now, I don’t want to hold any cash or fixed income, but I’ll review again when I’m 55. I’m happy with the drawdown level in the Q5 Plus portfolio but want 35% in non-US ETFs for balance.

Are there any circumstances where you’d move your own family out of equities into cash if you saw a crash coming?”

It’s a smart, nuanced question. And it goes to the heart of investing psychology: how do you balance prudence with paralysis?

The Seductive Logic of “Going to Cash”

Every investor fantasises about being the one who got out before the crash. But the reality? No one does so consistently.

JP Morgan’s 2024 Guide to the Markets found that the average investor underperformed the S&P 500 by around 3.5 percentage points per year over two decades - mainly because of badly timed exits and re-entries.

In other words, the biggest destroyer of wealth isn’t recessions. It’s fear.

As I tell members of my Great Investments Programme, “If you’re waiting for certainty before investing, you’ll never invest.”

With any of my model portfolios - they’re crash tested through the 2022 declines. So we have several choices:

Go into cash on a ‘daddy bear’ (see illustration) as an insurance policy, knowing you may end up buying back more expensively not more cheaply

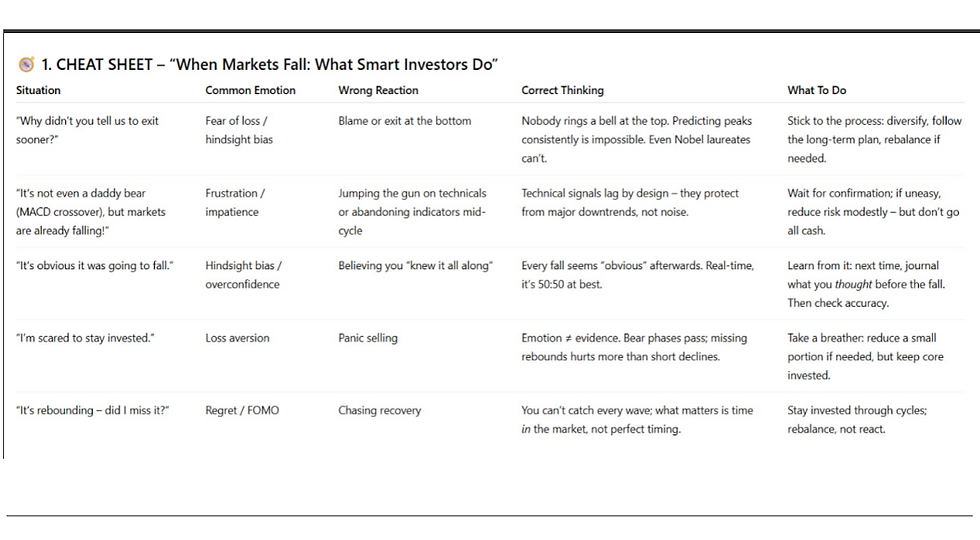

Smart investors respond to market declines with strategy, not emotion – here’s how professionals think when markets fall. Hold through it, after all we know we’ve crash tested it

Some combination of 1 and 2 based on your risk appetite not crystal ball gazing or premature panic

Buy more of the stocks as they fall – after all we liked them at the higher price and they are quality companies – this is the Warren Buffett approach

Why the Q5 Plus Portfolio Works Even in Turbulence

The Q5 Plus isn’t a speculative bet. It’s a quantitatively-built, globally diversified Quality-Growth-Income model.

Its filters - value, growth, profitability, and risk-adjusted returns (Sortino ratio) — are stress-tested against historic bear markets. In short: it’s designed for the inevitable bad years, not just the good ones.

Nobel laureate Eugene Fama demonstrated that risk premia exist because markets can fall without warning. Trying to time that fall destroys the very premium investors are paid to endure.

Diversification Beyond the US: Sense, Not Sentiment

Our reader’s instinct to diversify beyond the US makes sense. The S&P 500 now accounts for roughly 64% of global equity market capitalisation (MSCI World Index, Sept 2025). That dominance is as fragile as it is impressive.

European and Asian markets currently trade 20–40% cheaper on P/E ratios, offering the

same global growth at a discount.

A 35% allocation to ex-US ETFs - focused on high-quality developed-market stocks - helps avoid over-concentration while still capturing global momentum.

I, like Warren Buffett, am in US listed stocks. But actually these companies are so global that their footprints, earnings from countries like the UK are larger than British listed companies.

But you might feel psychologically calmer having something listed not in the world’s largest most profitable wealth creating market and prefer a tiny economy instead.

Perversely it’s legal listing does not mean it earns its profits there or is immune from market movements in an interconnected world. But people often have untested beliefs based on random thoughts and conversations in pubs.

So be it if that’s your source of financial education and information. Such habits are hard to let go.

When Would I Move to Cash?

Almost never. Cash is for expenses, not wealth creation.

The only reasons I’d take my family’s long-term money to cash are: daddy bears. (see image)

Otherwise, I prefer the pain of volatility to the certainty of zero return.

Or as Warren Buffett famously put it: “The stock market is designed to transfer money from the active to the patient.”

The Real Question: Can You Sleep at Night?

Investing isn’t about predicting storms. It’s about building a ship that survives them.

If you can sleep through volatility, your portfolio is doing its job. If not, hold more cash and hold portfolios which meet our criteria of quality, but satisfy your biases.

That’s exactly what the Great Investments Programme is built for - combining academic rigour with practical tools to help investors like you make patience profitable.

About Alpesh B Patel OBE

Alpesh is a former Bloomberg TV host, Financial Times columnist, and Dealmaker for the UK Government’s Global Entrepreneur Programme. He founded the Campaign for a Million to help one million people become smarter investors.

Learn more at www.campaignforamillion.com.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Investments can fall as well as rise, and you may not get back the amount invested. Past performance is not a guide to future returns. Please consider your own financial situation or seek regulated advice before making investment decisions.

Comments