The Star Investor Paradox: Why Famous Fund Managers Are Forgiven for Losing Money

- Alpesh Patel

- 2 minutes ago

- 5 min read

Why do famous fund managers get endless second chances - while unknown managers are quietly discarded for the same mistakes?

In a rational world, capital should follow performance.In the real world, capital follows identity.

Time and again, investors tolerate prolonged underperformance from celebrated “star” managers. Assets stay invested. Media narratives soften the blow. Confidence remains intact. Meanwhile, an anonymous manager delivering identical results faces redemptions, career damage, and professional exile.

This is not a market anomaly.It is a human one.

And understanding it matters deeply for anyone serious about long-term wealth creation.

When Fund Managers Reputation Overrides Returns

On paper, two managers with the same track record should be judged equally.

In practice, they are not.

Fame acts as a psychological shield. A well-known name reframes failure, absorbs criticism, and buys patience. An unknown name offers no such protection.

As shown in the “Anomaly of Unequal Tolerance” framework, famous managers retain assets, attention, and loyalty during weak periods, while anonymous managers face withdrawals and abandonment - even when the data is identical

This is the first uncomfortable truth:underperformance is not judged in isolation - it is judged relative to identity.

A Good Story Is More Forgiving Than Bad Returns

Numbers don’t comfort people.Stories do.

Famous managers rarely present raw performance alone. They present process:

“We are long-term thinkers.”

“This is contrarian discipline.”

“Short-term pain, long-term conviction.”

This narrative framing converts losses into virtue. Underperformance becomes proof of patience rather than evidence of error.

Without a narrative, losses feel like chaos. With a narrative, losses feel meaningful.

As the Narrative Protection model shows, identical events are interpreted differently depending on who delivers them. A star “sticks to the process.” An unknown manager is accused of incompetence.

This is why investors often defend losses more fiercely than gains—because abandoning the story creates psychological discomfort.

Why Being Wrong Together Feels Safer Than Being Right Alone

For advisers, trustees, and institutions, this bias is amplified by career risk.

Backing a famous manager is professionally safe.If it fails, everyone failed together.

Backing an unknown manager is dangerous.If it fails, the decision becomes personal.

This creates what behavioural finance calls institutional camouflage - where consensus protects reputations, even when it damages portfolios.

The Institutional Camouflage and Career Risk framework shows how collective ownership turns failure into shared responsibility, while isolated decisions become career threats.

This is why famous managers can survive years of weak returns while quieter, sometimes better-behaved strategies are abandoned early.

Authority Bias: When Expertise Becomes an Anchor

Once a manager is labelled an “expert,” their past success becomes an anchor of competence.

New information is filtered through that anchor:

Bad returns from a star = “bad luck”

Bad returns from an unknown = “lack of skill”

The data doesn’t change.The interpretation does.

This is authority bias at work - the tendency to overweight perceived expertise and underweight contradictory evidence.

As illustrated in the Authority Bias and Anchor of Competence framework, fame transforms uncertainty into comfort, even when reality disagrees.

Investors don’t just evaluate performance.They defend prior beliefs.

The Illusion That Skill Always Comes Back

Another powerful force keeps investors loyal to underperforming stars: the belief that genius is permanent.

We want to believe that:

Skill persists

Great investors always recover

Randomness can be conquered by intellect

Accepting that markets are noisy and that skill can fade is emotionally uncomfortable. Famous managers offer relief from that discomfort by embodying the myth of control.

The Illusion of Skill Persistence framework highlights this clearly: anonymous managers are seen as replaceable; famous managers are seen as exceptional.

This belief keeps capital locked in long after evidence weakens.

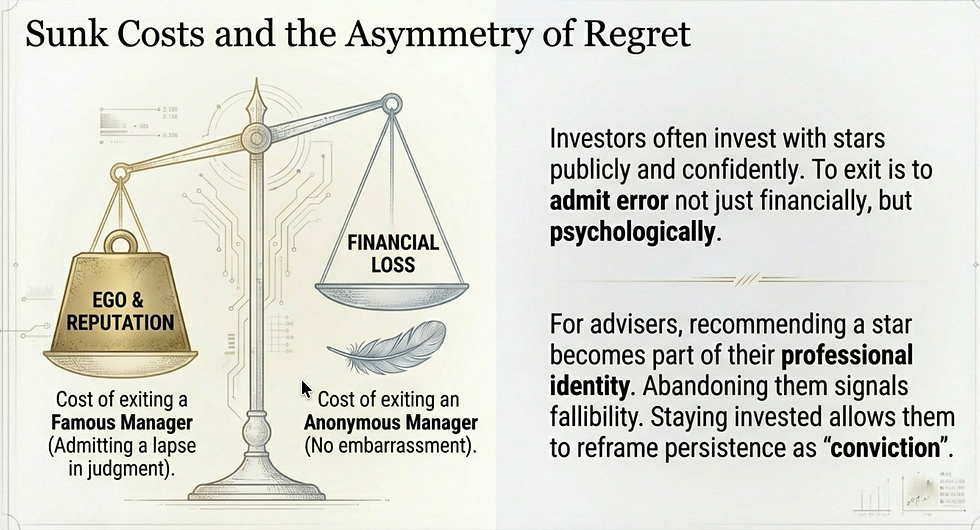

Why Selling a Star Feels Like Admitting Failure

Exiting a famous manager isn’t just a portfolio decision, it’s a reputational one.

Investors and advisers often back stars publicly and confidently. Selling later feels like admitting a personal mistake. Ego, identity, and sunk costs all collide.

By contrast, exiting an anonymous manager is quiet and painless.

This creates an asymmetry of regret: it feels psychologically safer to stay invested and hope than to admit error and move on.

The Sunk Costs and Asymmetry of Regret model shows how ego and identity can outweigh rational updating.

What This Reveals About Us as Investors

This paradox doesn’t mean investors are foolish.

It means they are human.

As summarised in the What This Reveals About Us framework:

We seek reassurance, not optimisation

We price stories higher than statistics

We value emotional continuity over rational updating

Markets may price assets efficiently but investors price narratives generously.

The Campaign For A Million Perspective

At CampaignForAMillion.com, the lesson is clear:

Fame is not a risk-management tool

Reputation is not a substitute for evidence

Conviction without accountability is not discipline

Independent investors must learn to evaluate process, incentives, and outcomes, not personalities.

The most dangerous words in investing are not “volatility” or “drawdown.” They are “Trust me.”

From Stories to Numbers: Stress-Testing Your Retirement Reality

Understanding behavioural bias is only half the job. The harder and more valuable step is removing narrative comfort and replacing it with evidence.

This is especially true when it comes to pensions.

Most investors don’t fail because they pick “bad” funds. They fail because they rely on reputation, reassurance, and past labels instead of regularly stress-testing whether their strategy still serves their future lifestyle.

That’s where practical tools matter more than opinions.

If you want to cut through storytelling and see how your decisions actually affect your retirement outcomes, the Great Investments Programme provides a set of pension and retirement calculators designed to do exactly that. Instead of asking “Do I trust this manager?”, they force the more useful question:

“If this return path continues, what does my retirement actually look like?”

By modelling contributions, growth assumptions, inflation, and drawdown scenarios, these calculators help investors move away from blind faith and toward informed, independent thinking, the core philosophy behind Campaign For A Million.

👉 Explore the pension calculators here: https://greatinvestmentsprogramme.atoms.world/

Final Thought: Who Are You Really Investing In?

Every portfolio contains two things:

Assets

Stories

The question is not whether stories matter - they always do.

The question is whether you are paying more for comfort than for competence.

Because in investing, the most expensive mistake is not being wrong.

It’s being comfortably wrong for too long.

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Past performance of any investment strategy or manager is not indicative of future results. All investing involves risk, including the potential loss of capital. Readers should conduct their own research and consider their individual circumstances before making any investment decisions.

Alpesh Patel OBE

Comments