The S&P 500's Historic Three-Year Surge: Does History Signal a Boom or Bust for 2026?

- Alpesh Patel

- Jan 8

- 4 min read

Updated: Jan 12

Introduction: The Three-Year Bull Run

The S&P 500 has officially closed the books on 2025, cementing a rare and powerful trifecta: its third consecutive year of double-digit gains. This impressive performance includes a roughly 17% jump in 2025, which followed gains of over 24% in 2023 and more than 23% in 2024.

Such a sustained period of high returns is a powerful driver of wealth but also a source of anxiety for investors wondering how long the party can last.

This prolonged bull run places the market in exceptionally rare territory.

An extended streak of such magnitude naturally leads to a critical question for every investor: With three strong years in the rearview mirror, what does history suggest might be in store for 2026? The data points to some surprisingly divergent possibilities.

We're Witnessing a Truly Historic Market Streak

A three-year streak of annual gains exceeding 15% is incredibly uncommon. According to analysis by Adam Turnquist, chief technical strategist at LPL Financial, this feat has only occurred two other times in the market's history since 1928.

The two previous instances were:

The dot-com bubble era, which saw a sustained run from 1995 through 1999.

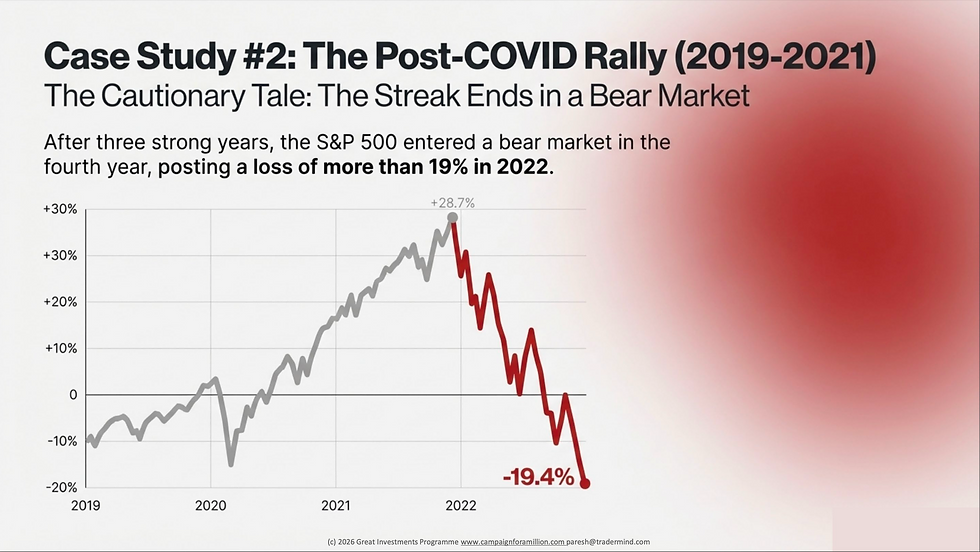

The more recent market surge from 2019 to 2021.

The rarity of this event is what makes the current market environment so significant.

Investors are navigating a situation with very few historical parallels, and as we'll see, those precedents offer conflicting clues about what to expect next.

History Points in Two Wildly Different Directions

The two historical precedents for the current market streak led to starkly different outcomes. This divergence underscores a crucial lesson: history provides context, not certainty.

First, the streak from 1995 to 1999 saw the bull market continue its powerful run even after its third year. However, the more recent example from 2019 to 2021 was immediately followed by a bear market in the fourth year.

In 2022, the S&P 500 posted a loss of more than 19%. This stark divergence means the historical parallel an investor chooses to focus on—the sustained boom of the 90s or the sharp reversal of 2022—will fundamentally shape their outlook for the year ahead.

Strong Performance Doesn't Automatically Mean a Crash Is Coming

While the rarity of the three-year streak is notable, zooming in on just the most recent year's performance provides a more optimistic outlook.

According to data from Bespoke Investment Group, 2025's gain of roughly 17% places it in the common category of annual returns between 10% and 20%.

The key statistic from their analysis is compelling: In the 23 other years since 1928 when the index rose between 10% and 20%, the following year saw a median rise of 11.8% and was positive 70% of the time.

This suggests that while caution is warranted due to the long rally, betting on an imminent crash goes against a strong historical trend of continued, albeit more moderate, market momentum.

Even a Good Year Will Likely Be a Bumpy Ride

Regardless of whether 2026 ends in positive territory, investors should brace for volatility. Adam Turnquist of LPL Financial describes the 2025 market as profoundly "resilient," noting it powered through significant volatility thanks to a strong U.S. economy, consistent double-digit corporate earnings, and a robust consumer.

Yet he emphasises that even strong bull markets are rarely a smooth, upward climb.

This expectation of turbulence is supported by historical data.

"When the index has posted at least a 15% annual price gain, next-year returns have averaged about 8%.

The average max drawdown during these years has been around 14%, serving as an important reminder that even strong bull markets are not linear."

A "max drawdown" of around 14% means that at some point during the year, the market could be down significantly from its peak—a sharp and worrying correction for any investor—even if it ultimately finishes with a positive overall return.

Setting the expectation for this kind of bumpiness is crucial for maintaining a disciplined strategy in 2026.

Conclusion: What's the Smart Move for 2026?

As we enter the new year, the S&P 500 stands at a historic crossroads. The market has delivered a three-year run of double-digit gains so rare it has only happened twice before since 1928.

Those two precedents point in opposite directions - one to a continued rally, the other to a bear market.

At the same time, broader data suggests that years with solid gains are often followed by another year of upside, albeit with significant volatility along the way.

The data suggests that while a 2022-style crash is the less likely outcome, a 14% intra-year drop is highly probable. The critical question for investors is not if the market will offer gains, but whether they have the discipline to endure the turbulence required to capture them.

Disclaimer

This content is provided for educational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instrument. Past performance is not indicative of future results. Investors should consider their own circumstances and seek independent advice where appropriate.

Alpesh Patel OBE

Comments