The World Economy in 2026: What It Means for Your Pension and the Future of Growth

- Alpesh Patel

- Oct 24, 2025

- 6 min read

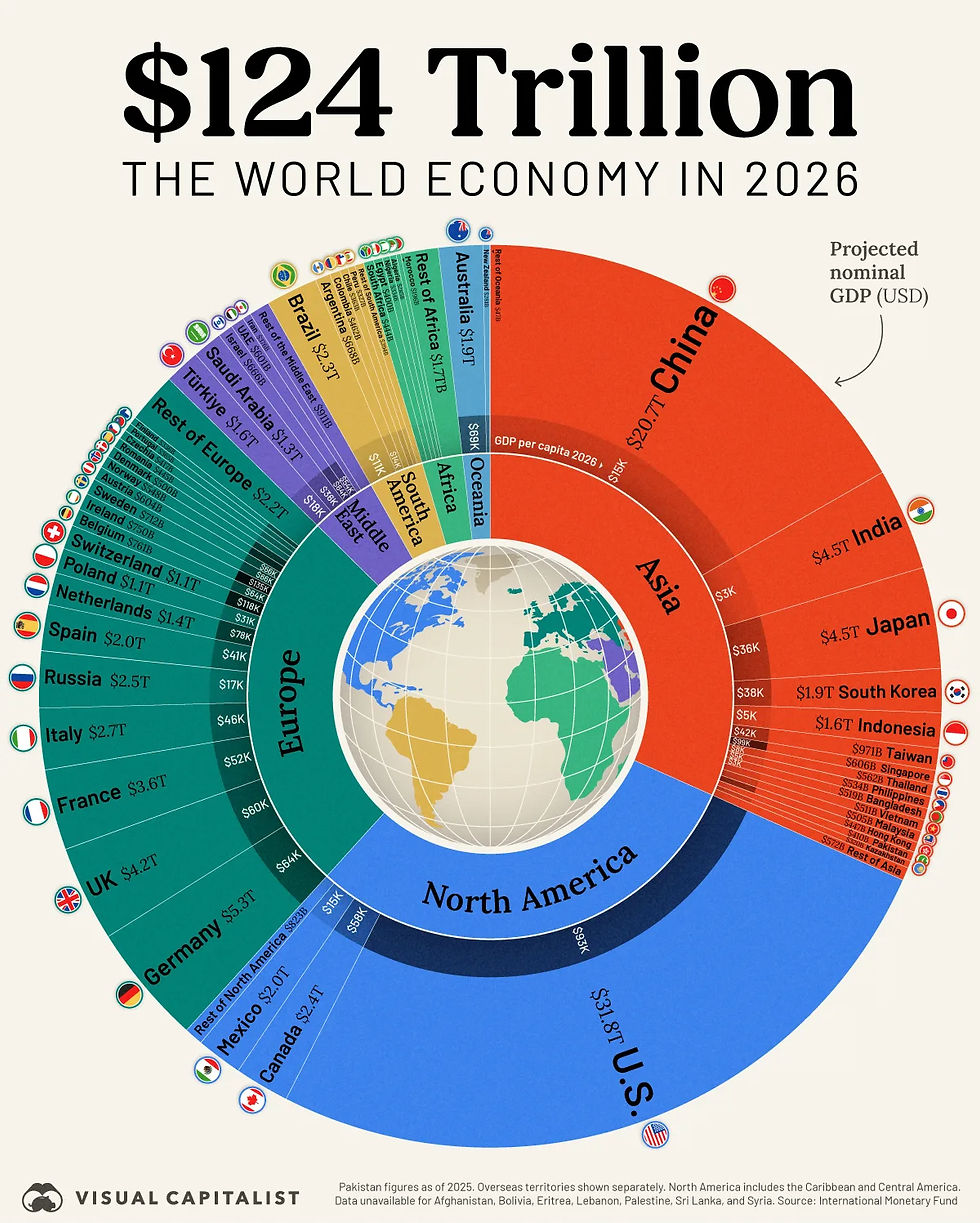

When I look at the latest projections for the world economy - especially the chart showing the global economy reaching $124 trillion by 2026 - one thing becomes immediately clear: The balance of global wealth is shifting faster than most people’s pensions are growing.

That’s not just a statistic - it’s a wake-up call.

Many investors assume that their pension pot, quietly compounding in a low-risk fund, will comfortably take care of them when retirement arrives.

But what if the world around that pension has completely changed by then?What if the regions driving future growth - like Asia, the Middle East, and parts of Africa - are expanding faster than where your pension is invested?

I’ve spent over 25 years analysing markets, from hedge fund trading floors to policy rooms at the Department for International Trade.

If there’s one lesson I’ve learned, it’s this: your financial future depends not on where the money is today, but on where the money is going tomorrow.

A World in Motion: The New Map of Global Power

The image you see - “The World Economy in 2026” - illustrates how economic power is shifting.

The United States remains dominant, accounting for roughly a quarter of global GDP.

China, while slowing slightly, continues to grow at a rate that most Western economies can’t match.

India, now the world’s fifth-largest economy, is projected to climb even higher by 2026.

The European Union, meanwhile, is seeing stagnation in growth - a sign of structural and demographic challenges.

These shifts aren’t just geopolitical talking points - they’re financial realities that will determine where investment opportunities emerge, and by extension, how well your pension grows.

Because whether you’re investing directly in equities or indirectly through a pension plan, your future returns depend on the global growth engine that powers those investments.

What This Means for Your Pension

Here’s the uncomfortable truth:If your pension portfolio is heavily exposed to low-growth markets or static bonds, you might be quietly losing purchasing power - even if the number on your statement looks reassuring.

Inflation and longevity are the two silent forces reshaping retirement security.

Let’s unpack that.

1️⃣ Longevity Risk: Living Longer Than Your Money

A few years ago, the average life expectancy in the UK was around 75. Today, it’s approaching 85 - and for many of you reading this, living to 90 or beyond is a real possibility.

That’s a wonderful achievement for humanity, but a massive financial challenge for your pension.

Every extra decade of life adds a decade of costs - food, healthcare, travel, utilities - all rising faster than the interest your pension may be earning.If your portfolio doesn’t grow faster than inflation, you risk outliving your savings.

This is what we call longevity risk - the danger that your money doesn’t last as long as you do.

It’s not a theoretical problem. Studies from major pension providers in 2025 show that 40% of retirees underestimate their lifespan by at least 10 years, and many pension models still assume post-retirement growth rates of under 3%.That’s not sustainable in a world where inflation averages between 3–5% and healthcare costs are rising faster still.

2️⃣ The Inflation Trap: The Quiet Erosion of Wealth

Even modest inflation can destroy the real value of your pension over time.

If your pension grows at 4% but inflation averages 3%, your real return - the purchasing power of your money - is just 1%.That means a £500,000 pension today might feel like £300,000 in 20 years’ time.

This is why I keep saying that growth investing isn’t a luxury - it’s a necessity. The old model of “playing it safe” with fixed income and waiting out the market worked when lifespans were shorter and interest rates were higher.

But in a world where economic power is moving eastward, and where innovation drives growth, sitting still can quietly become the riskiest strategy of all.

Global Growth Is Not Evenly Distributed

Looking at the 2026 world economy chart, one pattern stands out: most of the new wealth creation is happening outside traditional Western economies.

India and Southeast Asia are emerging as digital manufacturing and services powerhouses.

The Middle East is diversifying beyond oil, investing heavily in renewable energy, logistics, and AI infrastructure.

Africa is on the cusp of demographic acceleration, with a young, rapidly urbanising population that will drive consumption and production for decades.

Contrast that with Europe, where aging populations and sluggish productivity mean slower GDP growth and lower corporate returns.

Now imagine where your pension is invested. If 80% of it is tied to Western assets - bonds, domestic equities, low-growth funds - then you’re effectively missing out on the very regions driving the future of wealth creation.

What Investors Can Learn from Global GDP Trends

As an investor, I view this data not as a prediction, but as a probability map.It tells us where economic energy is concentrating and where long-term investment potential lies.

But it also reminds me of something critical:Pensions are not about preserving what you have. They’re about ensuring your money keeps up with the world you’ll be living in.

That requires a global mindset.

For example:

Exposure to technology, healthcare, and infrastructure in growing economies can offer long-term resilience.

Diversified portfolios across multiple currencies and growth markets can hedge against domestic stagnation.

And, crucially, staying invested through market cycles — not trying to time them — is the key to compounding.

The Mathematics of Growth

Here’s the simple arithmetic I often share with my clients:

If you invest £100,000 at a 5% annual return, you’ll have around £265,000 after 20 years.At 7%, that becomes over £387,000.At 9%, it’s nearly £560,000.

The difference between “safe” and “smart” growth isn’t just percentage points — it’s decades of financial independence.

That’s why, when we talk about pensions, I urge people to stop asking “How much have I saved?” and start asking, “How fast is my money growing relative to global opportunity?”

Because in an era where the world economy grows at 3–4% annually, your pension must at least match that — or you’re moving backwards in real terms.

Aligning Your Pension with a Global Growth Strategy

This doesn’t mean taking unnecessary risks or chasing every new trend.It means aligning your long-term pension strategy with the structural growth trends that are shaping the global economy.

In my own portfolio, I focus on:

Diversified exposure to high-growth regions like India and the U.S. tech sector.

Steady, compound-growth companies that benefit from secular trends like AI, green energy, and healthcare.

Reinvestment discipline - allowing growth to build upon itself over decades.

These are not tips or recommendations - they’re principles of prudent, growth-oriented investing that anyone can study and apply intelligently with professional guidance.

What This Means for You

If you’re in your 40s or 50s, the next decade is your most critical investment window.Your pension needs to be working harder than ever to outpace both inflation and longevity.

And if you’re already retired, you still need growth - because your retirement could last 25 to 30 years.In that time, the global economy will change dramatically, and static portfolios could lose real value.

That’s why understanding global trends, like the ones shown in the 2026 GDP forecast, is so essential.It helps you make informed decisions about where the world and your wealth are heading.

Why I Created the Great Investments Programme

When I founded the Great Investments Programme, my goal wasn’t to tell people what to buy or sell. It was to educate and empower individual investors - to help them think globally, act rationally, and invest with purpose.

Through the programme, I’ve shown thousands of people how to:

Evaluate global opportunities with data and logic, not headlines

Understand the real drivers of wealth creation

Build the confidence to take control of their investment journey

If you want to explore this further, I also recommend visiting www.campaignforamillion.com/tools - where you’ll find free educational pension tools that help you model your future growth needs.

Because as the world economy evolves, so must your approach to financial independence.

Final Thoughts

The image of the $124 trillion global economy is more than a chart - it’s a mirror showing where the next wave of opportunity lies.

If your pension isn’t growing in sync with that world, then even without a market crash, you may still be falling behind.

You don’t need to be a hedge fund manager to understand this - just someone willing to see beyond borders, challenge tradition, and embrace growth intelligently.

Your pension is your future - make sure it reflects the world you’ll retire into, not the one you grew up in.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Investment values can go down as well as up, and you may not get back what you invest. Past performance is not a reliable indicator of future results. You should conduct your own research or seek independent financial advice before making any investment decisions.

Alpesh Patel OBE

Comments