Why Growth Is the Real Engine of Financial Independence

- Alpesh Patel

- Oct 21, 2025

- 2 min read

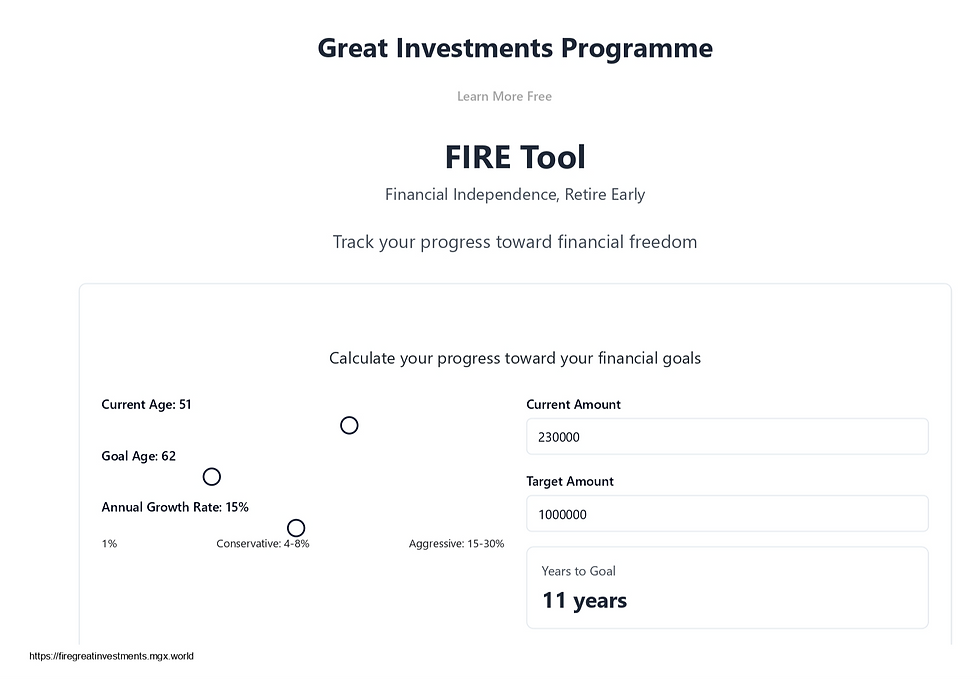

The secret to financial independence isn’t saving harder - it’s growing smarter. The FIRE Tool at firegreatinvestments.mgx.world makes that truth painfully clear: growth is the single variable that can turn a modest portfolio into a life-changing fortune.

Take the example from the report. A 51-year-old investor with £230,000 and a goal of £1 million by age 62 doesn’t need a miracle - just a 15% annual growth rate.

At that rate, they end up with about £1,070,050, overshooting the target by more than £70,000.

That’s the difference between retiring on schedule and still hustling at 70.

The tool vividly demonstrates the exponential nature of compounding: money begets money, which begets more money. “Interest on interest,” as the calculator puts it

, is the quiet engine that separates the merely frugal from the financially free.

At a 4% rate - the sort of return beloved by pension funds and government bonds - that same £230,000 would crawl to just under £370,000 in 11 years. Respectable, but nowhere near freedom. At 8%, it rises to roughly £530,000. Bump it to 15%, and it soars past the £1 million mark. Push for 20%, and you’re in multi-million-pound territory.

That’s not fantasy mathematics; it’s the raw logic of compounding. As Albert Einstein (perhaps apocryphally) said, compound interest is the “eighth wonder of the world.” The FIRE Tool turns that aphorism into a graph you can feel in your gut.

But growth doesn’t come without risk. The report is honest about this: “Conservative investments might return 4–8% annually, while more aggressive strategies could achieve 15–30%, but with higher risk”.

Anyone promising 20% returns without volatility is selling a fairy tale, not financial freedom. The key is consistency - avoiding the temptation to panic-sell during downturns or chase fads during bull markets.

This is where knowledge pays dividends. The difference between 4% and 15% isn’t just the market; it’s the investor. Those who understand valuation, risk-adjusted returns, and behavioural biases (and who use tools like firegreatinvestments.mgx.world) are playing a different game entirely.

The FIRE (Financial Independence, Retire Early) philosophy isn’t about early retirement per se. It’s about choice. Freedom from the tyranny of wages.

The ability to work because you want to, not because you have to. But without growth, the maths simply doesn’t work. No amount of austerity can outsave compounding.

In other words, growth is the oxygen of independence. It’s what turns a spreadsheet dream into a tangible lifestyle. Whether you’re 30 or 50, the FIRE Tool is a wake-up call: time and growth are the twin levers of wealth, and every year you wait, the lever gets shorter.

So before you obsess over the next budgeting app or coupon-clipping hack, ask the real question: how can I grow smarter? Because when your money starts working harder than you do, that’s when freedom begins.

Disclaimer: The FIRE Tool is for educational use and assumes a consistent growth rate without additional contributions. It is not financial advice. Always consult a qualified adviser before making investment decisions

Alpesh Patel OBE www.campaignforamillion.com

.

Comments