Understanding Stock Splits: How Efficiently Do Markets React to New Information?

- Alpesh Patel

- Aug 19, 2025

- 5 min read

When companies announce stock splits, investors typically buzz with excitement. But why does this seemingly routine event create so much market interest, and what exactly is happening beneath the surface?

Today, we uncover valuable insights from pioneering research to help investors navigate the nuances of stock splits effectively.

Groundbreaking studies by Eugene Fama, Lawrence Fisher, Michael Jensen, and Richard Roll, published in the International Economic Review, have thoroughly explored how rapidly markets adjust to new information around stock splits.

Their research has become essential reading for investors aiming to understand market efficiency and reaction patterns.

What Exactly is a Stock Split?

Before diving deeper, let's clearly define stock splits. A stock split increases the number of outstanding shares without changing the company’s overall market value.

For instance, in a 2-for-1 split, shareholders receive an extra share for each one they hold, effectively halving the stock price but doubling the number of shares.(Insert your visual illustrating a 2-for-1 stock split here, clearly showing how the total market capitalization remains unchanged.)

Breaking Down Stock Prices and Dividends

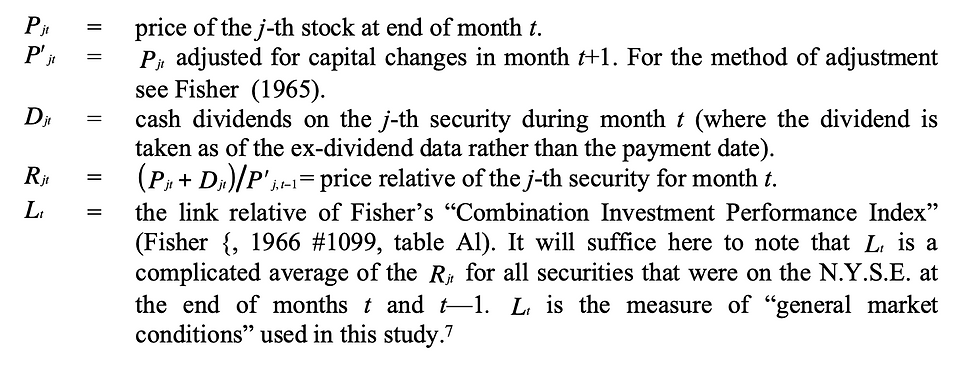

When examining stock splits, investors focus on three main components: 1. Stock price adjustments (Pjt and P'jt) 2. Dividends (Djt) 3. Relative market performance (Rjt and Lt) The following formula clarifies how these components interact

This image illustrates how researchers calculated stock returns relative to general market conditions, using price and dividend adjustments, providing a clear baseline to analyse splits.

Understanding the Data: Price Reactions and Splits

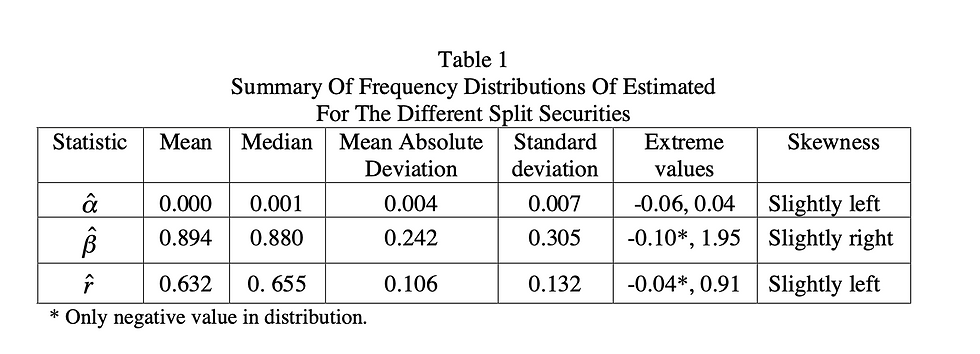

The researchers analysed 940 splits between 1927 and 1959 on the New York Stock Exchange. Their meticulous statistical analysis revealed how stocks typically behave around splits.

This table clearly breaks down statistical characteristics - showing how stock returns typically align or deviate from market behaviour around splits.

How Stocks Actually Behave Around Splits

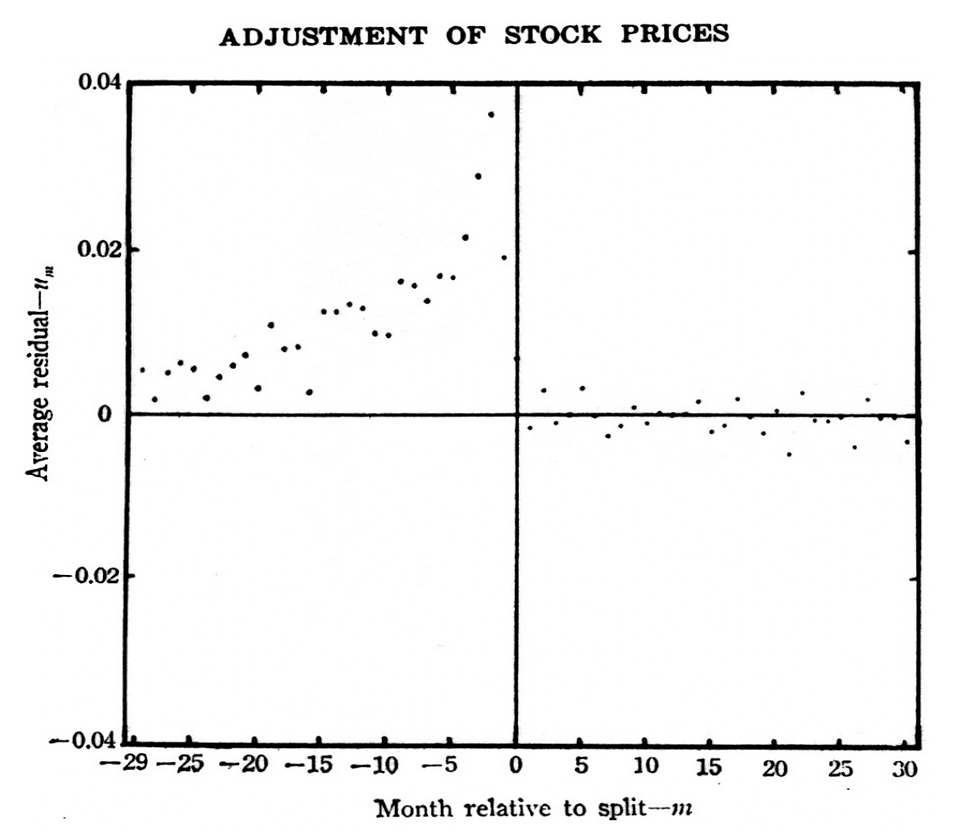

Fama and his colleagues discovered a crucial pattern: stock prices typically rise significantly months before a split announcement.

Once the split is complete, prices stabilise quickly, reflecting that the market has already priced in the anticipated positive information (usually higher dividends or earnings).

This graph highlights how average residual returns sharply increase in the months leading up to a split, peaking around the actual event, then stabilising shortly afterward.

Why the Early Spike in Prices?

Stock splits are generally interpreted as signals of financial strength. Companies often split stocks following periods of robust earnings and dividend increases. Investors anticipate this trend and thus begin pricing it in long before the official announcement.

This cumulative average residual chart clearly demonstrates how market optimism builds steadily, reaching its peak precisely as the split occurs.

The Crucial Role of Dividends

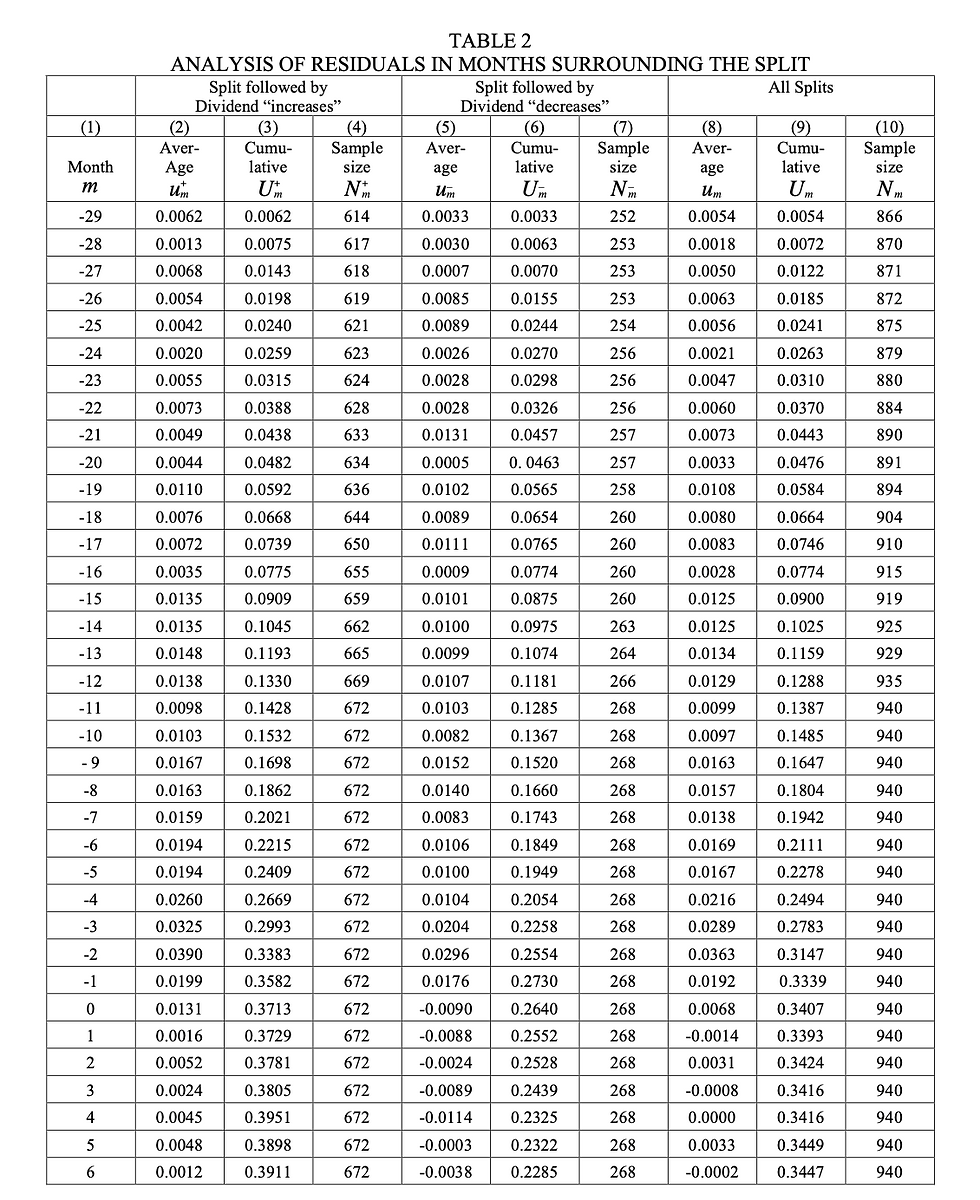

One critical finding from this landmark research is the role dividends play in driving stock prices around splits. Historically, splits have often been accompanied by dividend hikes above the market average.

These comprehensive tables clearly illustrate that stocks with increased dividends after a split perform significantly better than those with decreased dividends, confirming how dividend expectations shape investor reactions.

Volatility: A Key Consideration for Investors

While investors can feel optimistic around splits, there's a cautionary note—volatility often rises around these events. Increased volatility translates to heightened risk, reminding investors to be mindful of short-term fluctuations even if they expect positive long-term outcomes.

Historical Context: Splits in Market Cycles

Understanding historical context is crucial for investors. Stock splits are more frequent in bullish markets when general investor optimism is high. The historical data demonstrates that splits often cluster around periods of significant market performance.

This table aligns splits with overall market conditions, highlighting that splits increase dramatically during periods of market strength. A Global Wave of Stock Splits

Stock splits are not just a U.S. phenomenon confined to the likes of Apple or Tesla - they are a global market signal, often reflecting strong fundamentals and a bid to attract a broader investor base.

In the U.S., Interactive Brokers recently executed a 4-for-1 split, while companies like O’Reilly Automotive (15-for-1), Fastenal (2-for-1), and Coca-Cola Consolidated (10-for-1) have all followed suit, aiming to make their shares more accessible to retail investors.

Across Asia, Regencell Bioscience Holdings in Hong Kong grabbed headlines with a dramatic 38-for-1 split, sending its stock surging more than fourfold on the first trading day post-split.

India has also seen a surge of activity. Bajaj Finance, one of the country’s largest financial institutions, paired a 1:2 stock split with a 4:1 bonus issue to enhance liquidity and reward shareholders. BEML Ltd announced its first-ever 1:2 split, while Adani Power approved a 5-for-1 split in August 2025.

Taken together, these examples highlight that while stock splits do not alter intrinsic value, they serve as powerful psychological and liquidity tools across global markets.

Whether in New York, Mumbai, or Hong Kong, the story is the same: splits often cluster during periods of optimism, reinforcing investor sentiment while testing the very principles of market efficiency.

Can Investors Profit Easily from Stock Splits?

Fama’s extensive research provides a sobering perspective for speculative investors: the market absorbs split information rapidly, leaving minimal room for easy arbitrage.

By the time the general investing public is aware of a split, any short-term price benefits are typically already reflected in the stock's value.

This finding strongly supports the concept of market efficiency, asserting that prices accurately and swiftly reflect all available public information.

Investor Psychology and Behavioural Insights

Investor psychology plays a substantial role in shaping market reactions to splits. Psychological phenomena such as anchoring, herd behaviour, and confirmation bias can exaggerate price movements.

Investors often perceive splits as validations of their positive views on a company's prospects, reinforcing their bullish sentiments and potentially driving prices higher than justified by fundamentals alone.

Case Study: Apple's Stock Split Apple's 2020 4-for-1 stock split serves as a recent example. Investors responded enthusiastically, driven by strong fundamentals and expectations of continued growth, underscoring how splits can reflect underlying optimism rather than creating intrinsic value themselves. Practical Advice for Investors Here’s how investors of all calibers can effectively approach stock splits: Prioritise Fundamentals Over Events: Focus on underlying earnings growth, profitability, and long-term dividend sustainability rather than the event itself. Closely Monitor Dividend Behaviour: Changes in dividend policy post-split can confirm or challenge market optimism. Manage Volatility Carefully: Understand that splits might temporarily increase volatility; be mindful of your risk tolerance and investment horizon. Avoid Speculative Timing: Refrain from chasing short-term gains based on public information already reflected in prices. Information is King, Speed is Queen Fama’s landmark research confirms the rapid and efficient manner in which markets process information. For investors, this implies a disciplined approach to long-term value creation is more rewarding than short-term speculative strategies around widely-known events like stock splits. Ultimately, understanding how markets digest new information helps investors navigate the financial landscape more confidently, turning knowledge into investment wisdom. Disclaimer: Past performance is not indicative of future results. Stock market investments can fluctuate significantly. Investments carry risks, including potential loss of capital. This content is for educational purposes only and does not constitute personalised financial advice. Always seek professional advice tailored to your circumstances. References: Eugene F. Fama, Lawrence Fisher, Michael Jensen, and Richard Roll, The Adjustment Of Stock Prices To New Information, International Economic Review, 1969. Fisher’s Combination Investment Performance Index (1966). Efficient Market Hypothesis - Investopedia.Investor Psychology: The Power of Perception

Alpesh Patel OBE

Comments