Why Portfolios, Not Stocks, Decide Your Financial Future

- Alpesh Patel

- Aug 19, 2025

- 2 min read

When I show people the performance of my model portfolios, the first reaction is usually: “But which stock made the money?”

It’s the wrong question. That’s like asking a Test cricket captain, “Which single player won you the match?” The answer is: none. It was the batting order, the bowling attack, the field placement - the team.

Investing is no different.

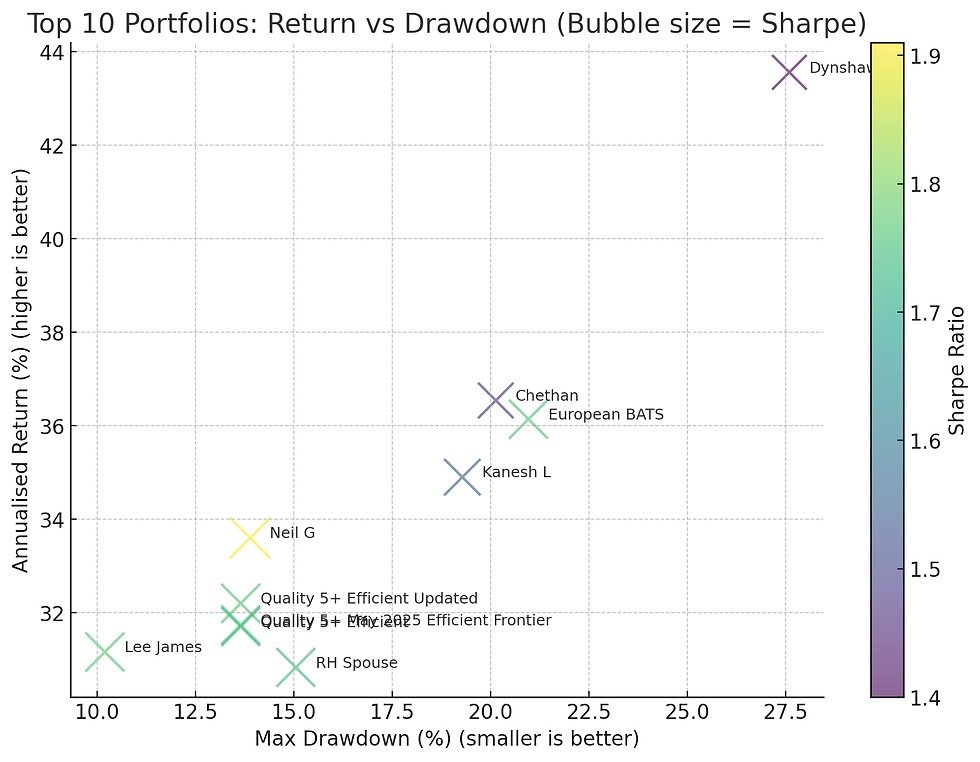

Over the past few years, my model portfolios have outperformed the benchmarks not because of some magical stock tip, but because of disciplined portfolio construction: diversification, risk management, and weighting. Take one portfolio I run as an example - over four years it returned nearly 300% with far lower volatility than the market average. Another compounded at over 600% in five years. Did I achieve this by chasing meme stocks or betting on the latest AI darling? No. The results came from a carefully designed system where losers were cut quickly, winners were allowed to run, and the portfolio was constantly balanced for risk.

Here’s the kicker. I did not know which stock would do the best, or indeed that some would sometimes fall, or which months or years would be stronger than others. I knew none of that. I don’t need to.

The obsession with the “one hot stock” is a colonial hangover. In the Raj, they told us to gamble on indigo or cotton, never to think of the bigger system of trade and value. But wealth is not built by lottery tickets. It is built by portfolios that can withstand wars, pandemics, and inflationary shocks - and still come out compounding.

Individual stocks are noise; portfolios are signal. A single share can halve overnight on a profit warning. But a robust portfolio will absorb the hit, because the other assets - carefully chosen for growth, value, and resilience - are there to carry the weight. This is why the wealthy do not buy “stocks.” They buy portfolios.

For British Indians in particular, the lesson is vital. Too many still treat investing like a weekend flutter at the bookies, looking for the one stock to double by Diwali. That mentality is why pensions underperform and portfolios stagnate. The serious investor asks: “What structure of holdings will protect my downside and compound my upside?”

So, the next time someone asks me which stock I’m buying, my answer is simple: I’m not buying a stock, I’m building a portfolio. That is how wealth is created - not by picking winners, but by being a portfolio manager of your own future.

If you want financial independence, stop acting like a punter and start acting like a portfolio manager. After all, no one remembers who hit a six in the 23rd over. They remember who lifted the trophy.

Alpesh B Patel www.campaignforamillion.com Disclaimer: The information provided here is for educational purposes only and should not be considered investment advice or a recommendation to buy or sell any financial product. Past performance is not a reliable indicator of future results.

All investments carry risk, including the potential loss of capital. Individuals should conduct their own research and, where necessary, seek independent financial advice before making investment decisions.

Comments