2026 Market Outlook: Navigating the Transition from AI-Led Growth to a Broad-Based Productivity Cycle

- Alpesh Patel

- 1 day ago

- 4 min read

Updated: 3 hours ago

Introduction: A Clearer Market Outlook Beyond Recency Bias

The "expiration date" anxiety currently haunting Wall Street is a byproduct of recency bias rather than rigorous data.

Many market participants treat the calendar like a ticking clock, assuming that three years of standout returns must naturally signal an imminent collapse.

However, we must distinguish between "late cycle" and "end cycle" dynamics. The 2026 market outlook suggests the expansion is not exhausted, but rather transitioning into a more sophisticated, broadly distributed phase of growth.

2026 Market Outlook: The Fourth Year Phenomenon in Market Performance

History serves as the ultimate psychological shock absorber for the modern investor navigating a mature expansion. Most bull markets endure for five to seven years, and data confirms that those reaching a fourth year have historically delivered positive returns without exception.

This historical precedent provides a sturdy floor for valuations, suggesting that maturity is often a precursor to stability rather than a crash.

Investors who recognise this pattern can maintain valuation discipline while others retreat prematurely due to unfounded fears.

"The bull cycle may be mature, but it’s not over yet." This part of the market outlook emphasises valuation discipline over emotional trading, encouraging investors to resist the temptation to retreat based on fear alone.

The Dovish Pivot: Why a Policy-Triggered Downturn is Unlikely

A policy-triggered downturn remains unlikely as the Federal Reserve maintains a dovish-leaning path, eschewing the restrictive measures that typically catalyze bear markets.

We are entering 2026 with the residual momentum of 2025’s rate cuts, providing a lingering monetary cushion for equities.

Fiscal idiosyncratic drivers are also providing a secondary engine for real GDP growth. A projected $170 billion stimulus injection, fueled by tax relief on overtime and tips, is expected to bolster consumer spending through the first half of the year.

Furthermore, incremental deregulation is unlocking lending capacity for both European and U.S. banks. These financial institutions remain attractively valued and are positioned to act as vital conduits for this late-cycle liquidity.

Beyond the "Magnificent 7": The Looming AI Productivity Revolution

The transition from 2025’s hyperscaler dominance to a broad-based productivity wave is the defining narrative for the 2026 horizon. We are witnessing a secular tailwind where AI-driven efficiency gains finally permeate the equal-weighted indices and the broader economy.

Healthy skepticism regarding an "AI bubble" is actually a constructive force, as it prevents the overheated exuberance that typically precedes a market peak.

For intellectual context, the S&P 500 peaked at 28x forward P/E during the 1990s Internet boom; current valuations remain significantly more disciplined.

Asia’s semiconductor industry stands as a primary beneficiary of this broadening rally as hardware demand remains structural and robust. This shift mirrors the 1990s, where the most significant economic windfalls arrived several years after the initial technological adoption phase.

"An AI productivity revolution that extends beyond the 'Magnificent 7' hyperscalers into the broader economy could power a late-cycle surge of the bull market over the next several years."

The Sentiment Paradox: Why Grumpy Consumers are a Bullish Signal

The current "Wall of Worry" is a classic bullish setup, characterized by consumer sentiment levels that are remarkably worse than those recorded during the Great Financial Crisis.

This sentiment paradox suggests that because there is no widespread euphoria, there is very little "froth" to be blown off the market.

Restrained optimism among the public acts as a governor on market overheating. This lack of exuberance allows valuations to remain grounded even as the economy absorbs the benefits of fiscal stimulus and technological advancement.

The Global Diversification Play: Finding Value Outside the U.S.

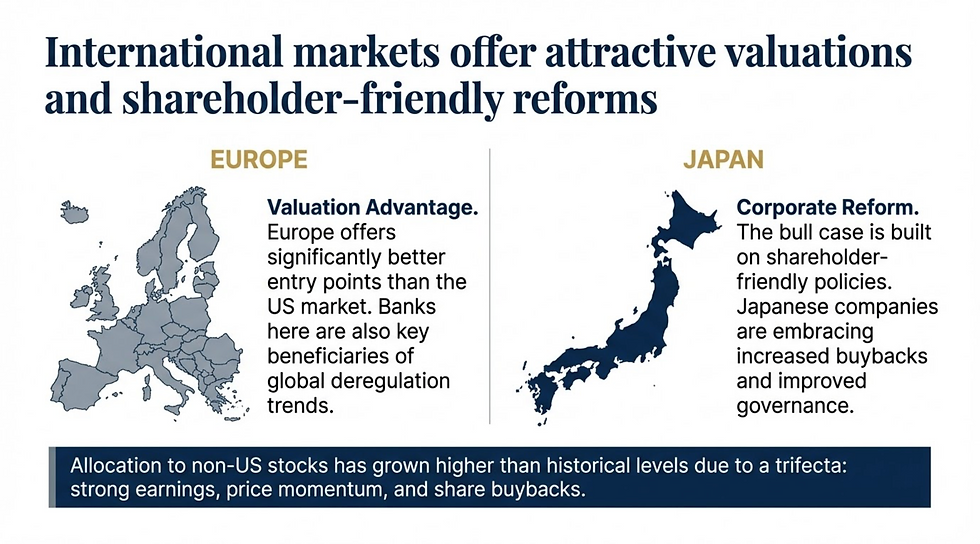

To navigate the 2026 international landscape, we utilize a rigorous selection "trifecta": robust earnings trends, sustained price momentum, and active share buybacks. This methodology identifies regions where structural improvements are decoupling from global volatility.

• Japan: Aggressive corporate reforms are fostering a shareholder-friendly environment, resulting in record-level buybacks and improved capital efficiency.

• Europe: Attractively valued financials and cheaper entry points offer a compelling, high-quality alternative to the premium-priced U.S. megacaps.

• Emerging Markets: Historically, these markets thrive as the U.S. dollar begins to weaken—a trend we expect to persist throughout the coming year.

Conclusion: Distinguishing "Late" from "End"

While the U.S. midterm elections will likely introduce bouts of volatility, these corrections should be viewed as healthy entry points within a long-term upward trend.

The structural forces of supportive Fed policy, fiscal relief, and the broadening AI boom remain the primary engines of this expansion.

The transition from a tech-led sprint to a broad-based economic surge is not an ending, but an evolution. The real question for 2026 is whether investors have the vision to ignore the maturity myth and follow the underlying data.

"In short, a 'late cycle' bull market is not necessarily the same as an 'end cycle' bull market."

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Past performance is not a reliable indicator of future results. All investing involves risk, including the loss of capital.

Alpesh Patel OBE

Comments