Navigating the Market in 2026: A Strategic Investment Framework

- Alpesh Patel

- Dec 31, 2025

- 6 min read

Updated: Feb 9

Introduction: A Framework for Navigating the Path Ahead

The current market environment is marked by high returns. This has led many investors to feel complacent.

In this analysis, I’ll provide a strategic framework for navigating the path to 2026. It’s grounded in data-driven principles and a long-term investment philosophy.

This framework aims to cut through speculative narratives and focus on the fundamental drivers of sustainable wealth creation.

My core investment philosophy emphasises investor discipline, emotional stability, and a strong focus on fundamental data over market "noise."

Success in investing isn’t about constant activity; it’s about strategic inaction. Unlike trading, true investing involves acquiring high-quality assets and having the discipline to do nothing 99% of the time. This allows the power of compounding to work its magic.

This outlook will first establish the macroeconomic landscape. Then, I’ll delve into the dominant market themes, assess key risks, and outline a practical approach to portfolio construction.

By understanding these factors, I believe investors can build a resilient strategy that thrives not just in 2026, but for years to come.

The Core Macroeconomic Environment

Understanding the fundamental economic drivers of the market is crucial.

These macroeconomic trends provide essential context for the investment landscape. However, they should not trigger reactive, short-term portfolio adjustments.

Instead, they form the backdrop against which my data-driven, company-specific analysis is performed.

Interest Rate Trajectory

The expected path for interest rates in both the UK and the US is downward. This trend is straightforward and generally positive for equity markets.

As rates fall, governments see reduced debt repayment costs. Corporations benefit from lower borrowing costs for expansion. Consumers gain increased spending power as mortgages and loans become cheaper.

This tripartite stimulus—benefiting government, corporate, and consumer spending—provides a solid foundation for the stock market.

Global Growth and Economic Health

The global economic picture is mixed but shows signs of strength. While UK growth remains sluggish and US unemployment has reached a five-year high, it’s crucial to remember that markets are forward-looking.

Historically, the start of a recession often marks the bottom of the stock market. Investors have usually priced in the downturn by that time.

A more telling indicator of real-time global demand is the price of industrial commodities.

For instance, copper is currently at an all-time high, reflecting robust global growth and industrial activity.

Fiscal and Regulatory Environment

The broader policy environment provides a positive backdrop for investment. Current fiscal policy, with tax rates that are not overly burdensome, allows capital to flow freely through the economy.

Additionally, a trend toward deregulation, particularly in the United States, is reducing friction for businesses and encouraging investment.

This macroeconomic backdrop of falling rates and abundant capital doesn’t lift all boats equally. Instead, it acts as a powerful accelerant for the concentrated, capital-intensive themes that now define market leadership.

Dominant Market Themes and Key Drivers

A deep dive into the current market reveals that a few concentrated forces are driving the majority of recent gains.

Understanding these dominant themes is critical for positioning a portfolio for 2026. They represent the primary engines of capital appreciation and economic transformation.

The AI Revolution’s Economic Impact

The economic influence of Artificial Intelligence (AI) is staggering and continues to accelerate. The scale of this trend is best understood through key data points:

Five leading AI firms now account for 27% of all capital expenditure within the S&P 500.

AI-related stocks are driving 55% of the US stock market's recent gains.

Moreover, the pace of technological advancement is unprecedented. AI training compute capacity is doubling approximately every six months.

This suggests that the market may still be underestimating the long-term economic impact of this revolution.

The Unprecedented Scale of Mega-Cap Companies

The market is increasingly dominated by a handful of mega-capitalisation companies of an unprecedented scale.

The total market capitalisation of the US stock market stands at £70 trillion, more than double the US GDP of approximately £30 trillion.

The investment implications of this are profound. These corporations wield financial power that exceeds that of many national governments. This allows them to create monopolistic or near-monopolistic conditions that are highly beneficial for their shareholders.

From a purely amoral, capitalist perspective, the strategic choice is clear: it’s better to be on the side of the mafia than the little guy.

Assessing Market Risks and Investor Psychology

A responsible, forward-looking analysis must include a sober assessment of potential risks.

However, experience shows that the greatest risk to long-term returns is often not a market event, but an investor's behavioural reaction to that event.

Deconstructing “Bubble” Concerns

Concern | Counterpoint | Strategic Implication |

High Valuations | Market-wide valuations remain below the peaks of previous bubbles, such as the dot-com era. | Focus on individual company fundamentals and profitability, not just abstract market-level valuation metrics. |

Identifying Market “Noise” vs. Signal

A significant portion of financial media and market commentary is "background noise." This noise is designed to provoke activity, not to inform strategy.

The following factors should be recognised as distractions that should not dictate investment decisions:

War in Europe (e.g., Russia/Ukraine)

Aggregate global debt levels (e.g., £100 trillion in global debt)

Tariffs and ongoing trade disputes

Sector rotation narratives promoted by brokers and financial newsletters

Anticipating Market Downturns

Volatility is a normal and expected feature of investing. Based on current conditions, my analysis indicates a 70% probability of a 10% or greater market drop within the next six months.

This should not cause panic; it’s a predictable "pit stop" in a long-term journey.

Historical data confirms that bear markets, while sharp, are significantly shorter and less frequent than the bull markets that generate long-term wealth.

Strategic Portfolio and Asset Allocation for 2026

A resilient portfolio isn’t built on complexity or an attempt to forecast the future with perfect accuracy.

It’s built on a clear, simple, and disciplined process that prioritises quality and manages risk through sensible allocation.

Core Allocation Principle: Stocks and Cash

My model is built on two primary asset classes: stocks and cash. Risk is managed simply by adjusting the allocation between these two pillars.

Adding complexity through alternative assets like property, gold, or Bitcoin often dilutes focus without adding commensurate risk-adjusted returns.

Geographic Focus: The US Market Advantage

Data makes a compelling case for prioritising US equities over other developed markets, such as the UK. A ten-year historical comparison illustrates this starkly:

£1,000 invested in the UK market grew to £1,640.

£1,000 invested in the US market grew to £3,790.

The Four Reactions to Market Movements

Market Condition | Appropriate Investor Action | Rationale |

Market Rises | Do nothing or add to positions. | Let winning positions compound. |

Market Falls | Buy more of high-quality holdings or do nothing. | Acquire superior assets at discounted prices. |

“Noise” | Do nothing. | Avoid costly, unnecessary trading. |

The Profile of a Resilient Company

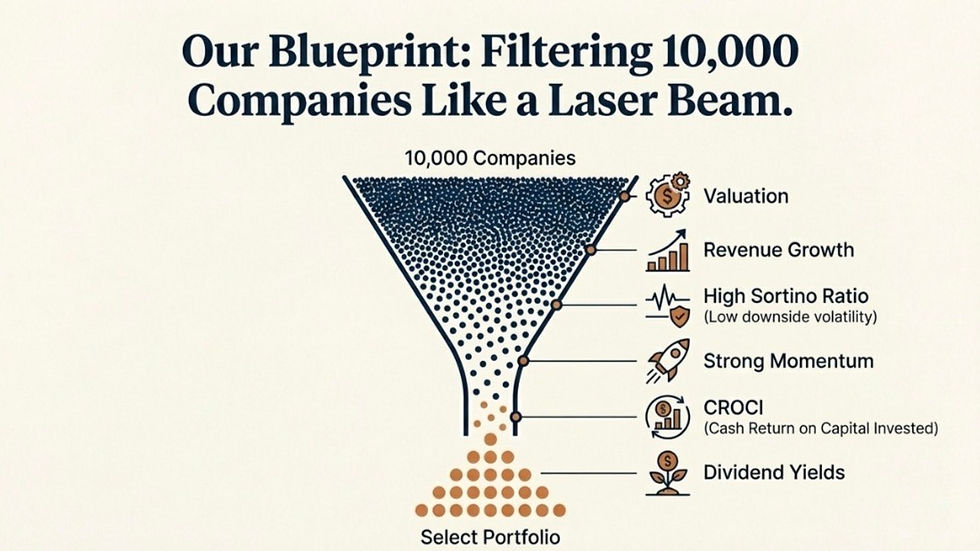

My methodology for selecting individual companies is based on a strict, quantitative checklist:

Undervalued

High Revenue Growth

Dividend Yields

Strong Cash Flow & High Return on Capital

High Average Returns with Low Downside Volatility

A Cautionary Note on the Fund Management Industry

A successful investment strategy requires scrutinising not just what you invest in, but how you invest.

Documented Underperformance

Analysis from outlets like the Financial Times consistently highlights that many large, big-brand funds are serial underperformers. For example, a global fund turned an initial £100 investment into just £66 during a period of strong market performance.

The Problem with High Fees

High fees are a significant drag on long-term returns. One common tactic is “double dipping.” This occurs when a fund advertises a low headline fee but invests client capital into higher-fee internal funds.

Conclusion: Maintaining Discipline in 2026

As I look toward 2026, navigating the market successfully will depend less on predicting the future and more on adhering to a timeless, data-driven process.

The entire analysis can be distilled into three primary takeaways for the disciplined investor.

Trust Data, Not Narrative. The anchors of a successful strategy are market fundamentals, corporate profitability, and a quantitative selection process.

Macroeconomic stories, geopolitical events, and media hype are powerful distractions that lead to poor, emotionally-driven decisions.

Focus on the numbers that matter: valuation, growth, and quality.

Embrace Volatility as Opportunity. Market downturns are not a matter of "if," but "when." They are an inevitable and healthy part of the economic cycle.

Rather than being a source of fear, these periods of volatility should be viewed as valuable opportunities to acquire high-quality assets at more attractive prices.

Focus on Portfolio Quality and Simplicity. The most effective strategy is often the simplest.

Construct a focused portfolio of 20-40 high-quality, predominantly US-based companies that meet strict quantitative criteria.

Once this foundation is in place, the most powerful action an investor can take is to have the discipline to do nothing and let the strategy work.

For those who remain calm, trust their process, and focus on the long-term horizon, the prospects for building sustainable wealth remain exceptionally strong.

Disclaimer

This content is provided for educational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instrument. Past performance is not indicative of future results. Investors should consider their own circumstances and seek independent advice where appropriate.

Alpesh Patel OBE

Comments