Is the American Market Overvalued? So What Does it Mean?

- Alpesh Patel

- Sep 8, 2025

- 4 min read

Let’s start with the charge sheet. The S&P 500’s forward 12-month P/E sits a little above 22, well north of its 10-year average around the high-teens.

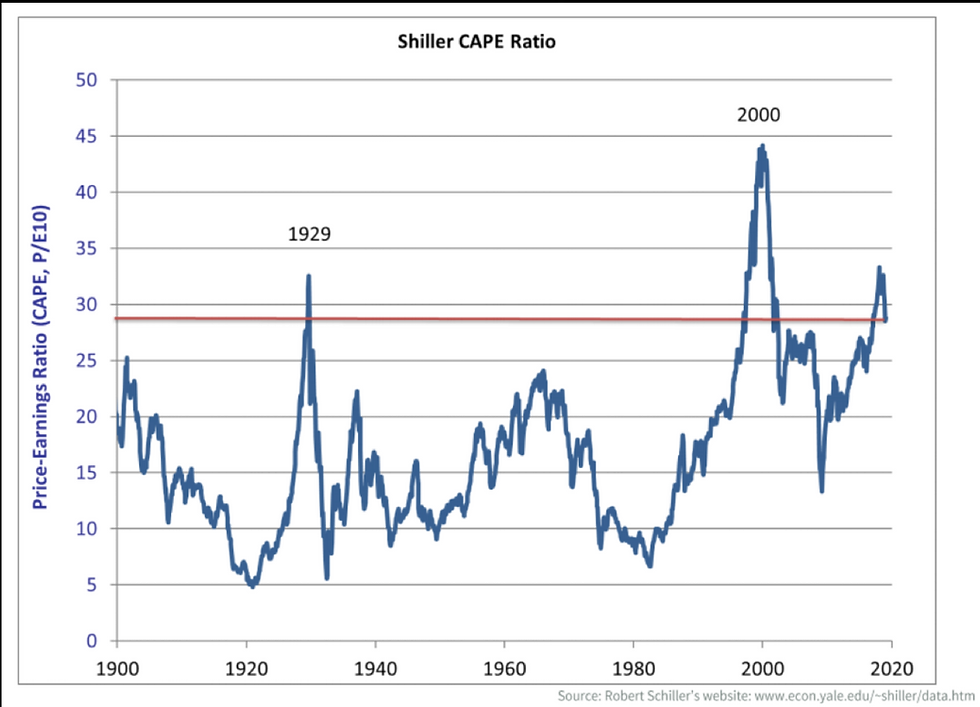

The Shiller CAPE is hovering near 38, a level historically associated with rich pricing.

Verdict: expensive by most yardsticks. But expensive is not the same as un-investable, and valuation is an unreliable stopwatch for market timing.

Valuation is a poor short-term forecaster

Serious research shows valuation has some power over very long horizons but is weak to useless for one, three, even five-year timing. Vanguard’s multi-decade study found P/E-based signals explained only about 40% of the variation in real returns at long horizons and far less over shorter ones. In other words, shouting “CAPE!” is not a strategy. Earnings growth, margins, interest rates and risk premia matter, and they move.

A useful refinement is to adjust valuation for the macro backdrop. “Fair-value CAPE” work, for example, shows the multiple that makes sense changes with real rates and inflation. If discount rates fall or productivity improves, higher multiples are not necessarily bubble territory.

Damodaran’s implied equity risk premium points to the same nuance: expected returns are a function of price, cash flows and rates. His 2025 updates put the US implied ERP a touch above 4% recently – not cheap, not absurd – which is entirely consistent with “rich but rational if earnings deliver.”

Cash still loses the long game

Yes, 3-month T-bills around 4% feel comforting. Comfort is not compounding. Over 125 years, global equities beat both bonds and bills after inflation, with a roughly 4.3% real premium over cash in the 21st century to date.

That is the oxygen of pensions. Park in cash for a year while you wait for Godot-the-Correction if you must, but recognise the opportunity cost of missing equity risk premia.

If you need more motivation to avoid market-timing purgatory: decades of data show most wealth creation comes from a small minority of stocks. Miss the winners and you can match T-bills with equity-like volatility - a terrible trade.

Bessembinder finds the top 4% of US companies generated the entire net market gain since 1926. Translation: broad, disciplined equity exposure beats heroic stock picking and cash dithering.

If you’d like to explore the data behind this in more detail, UBS publishes the Global Investment Returns Yearbook, a landmark study of 125 years of financial history across global markets.

The public summary edition for 2025 covers equities, bonds, bills, diversification, and factors, and is widely regarded as the gold standard reference for long-term returns. You can read the full summary here:

“Overvalued” does not mean “uninvestable”

What moves returns from here? Earnings growth and breadth. Analysts still expect double-digit EPS growth into 2026, and forward P/Es that look stretched can compress harmlessly if profits catch up. Sector dispersion is also rising, which is what you want if you actually do research.

Crucially, quality matters. Decades of peer-reviewed evidence show that profitable, conservatively financed, well-managed firms deliver superior risk-adjusted returns. Call it profitability and investment in Fama-French. Call it Quality-Minus-Junk in Asness-Frazzini-Pedersen. Call it common sense. It is the antidote to fretting about the index multiple.

What this means for pensions

Cash is a holding pen, not a home. Today’s T-bill yield near 4% is fine for near-term liabilities, not for decades-long purchasing power. History still says equities outcompete cash by wide margins over realistic pension horizons.

Stop treating valuation as a weather forecast. Expensive markets can keep rising if cash flows grow or discount rates fall. Cheap markets can stay cheap. Use valuation for expectations and risk control, not red-button timing.

Own resilience, systematically. The Great Investments Programme tilt to resilient companies - high profitability, strong balance sheets, sensible reinvestment, and diversification - is precisely what the academic literature rewards. In a market where a minority of firms create most of the wealth, process beats punditry.

Bottom line

Yes, the American market screens rich. No, that does not make cash your friend. For pension savers, the rational play is not to outguess the next 300 points on the S&P 500. It is to stay invested in resilient businesses, sized to your risk, rebalanced with discipline, and judged over years, not headlines. The roof matters more than the weather.

Sources: FactSet Earnings Insight; Yardeni Research; UBS/LBS Global Investment Returns Yearbook 2025; Vanguard Research on return forecasting; Bessembinder (SSRN); Fama-French (2015); Asness-Frazzini-Pedersen (2019); FRED 3-month T-bill yields; Damodaran implied ERP. (factset.com, insight.factset.com, United States of America, Fairway Wealth Management, LLC, SSRN, FRED, pages.stern.nyu.edu)

Disclaimer

This article is for educational and informational purposes only and does not constitute financial advice, investment research, or a recommendation to buy or sell any security. The views expressed are based on publicly available data and academic research. Past performance is not a reliable indicator of future results. All investments carry risk, including the risk of loss. Readers should consider their individual circumstances, risk tolerance, and consult a qualified financial adviser before making any investment decisions. Alpesh B Patel OBE www.campaignforamillion.com

Comments