Stablecoins 4 Surprising Truths About the Future of Money, According to a New Citi Report

- Alpesh Patel

- Oct 1, 2025

- 4 min read

In the noisy world of digital finance, where narratives often outpace reality, Citi's "Stablecoins 2030" report lands with the force of data-driven gravity.

Its findings don't just temper the hype around a blockchain-powered future; they redirect our attention to where the real revolution is brewing.

This post distills the four most surprising takeaways from the report that force us to reconsider common assumptions about the future of digital money.

Listen: Stablecoins, Bank Tokens & The $4 Trillion Shift 1. The Biggest Player in On-Chain Money Might Not Be Stablecoins

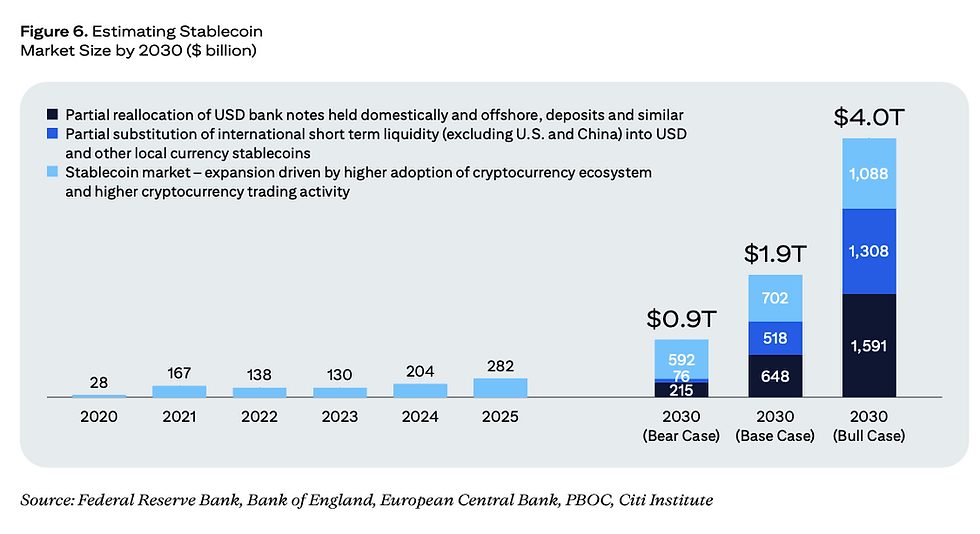

While the report forecasts a massive market for stablecoins—revising its 2030 base case upwards to $1.9 trillion and its bull case to $4.0 trillion in issuance—what's striking is its focus on an even larger potential player: bank tokens.

Bank tokens, a form of digital money issued by regulated commercial banks like tokenised deposits, could see staggering adoption.

The report outlines a potential scenario where a modest 5% shift of global large-value payments to on-chain rails could drive $100 trillion to $140 trillion in annual bank token transaction volumes. The reason for this explosive potential is surprisingly simple: "they can be integrated more easily into existing treasury, ERP, and payment workflows."

Instead of crypto "burning down the existing system," this suggests banks are poised to reimagine it from within. For fintech innovators and corporate treasurers alike, the strategic implication is clear: the future of finance is more likely to be an evolution led by trusted incumbents than a pure disruption from the outside.

2. Large Corporations Are "Curious, Not Enthusiastic"

While banks are quietly building the future, the report reveals that their largest corporate clients are proceeding with caution—a reality that challenges the prevailing "mass adoption" narrative. The finding is blunt: "Most mainstream corporates are currently curious rather than enthusiastic about stablecoins."

The reasoning is practical. Large corporations often already have access to fast, low-cost payment systems. Their primary concerns are regulatory and reputational risks, making them "likely to favour 'bank tokens' over public blockchain based stablecoins."

However, this data forces us to look elsewhere for the truly transformative impact. The report pinpoints that stablecoins are likely a game-changer for small and mid-sized businesses (SMBs), especially those in emerging markets who face higher costs and slower settlement times with traditional banking. As Ricardo Correia of Bain & Company notes in the report:

Among the emerging use cases for stablecoins, cross-border B2B payments for small and medium-sized businesses (SMBs) stand out as the most compelling. These firms have historically been underserved when moving money across borders, particularly in emerging markets.

For entrepreneurs and investors, this insight clarifies that the most fertile ground for stablecoin innovation isn't in competing with the Fortune 500's treasury systems, but in building financial rails for the globally underserved.

3. Stablecoins Could Massively Reinforce U.S. Dollar Dominance

The stablecoin world is overwhelmingly denominated in U.S. dollars, a trend the report expects to continue, with around 90% of supply remaining dollar-pegged in its 2030 base case. But the analysis goes further, introducing the powerful concept of stablecoins acting as a "Eurodollar 2.0."

Just as the Eurodollar market created massive offshore demand for dollars in the 20th century, stablecoins are creating a new, digitally native offshore market for U.S. dollar assets. The scale of this impact is stunning: in the base case scenario, stablecoin growth is expected to drive $1 trillion plus in new demand for U.S. Treasuries by 2030.

While this extends U.S. financial influence, it also creates significant geopolitical risk for emerging economies, including a potential loss of monetary sovereignty and increased volatility from rapid capital flows. For policymakers and global investors, this trend represents both a powerful structural tailwind for the dollar and a new vector of systemic risk that demands careful monitoring.

4. It’s a "ChatGPT Moment," But Scale is Relative

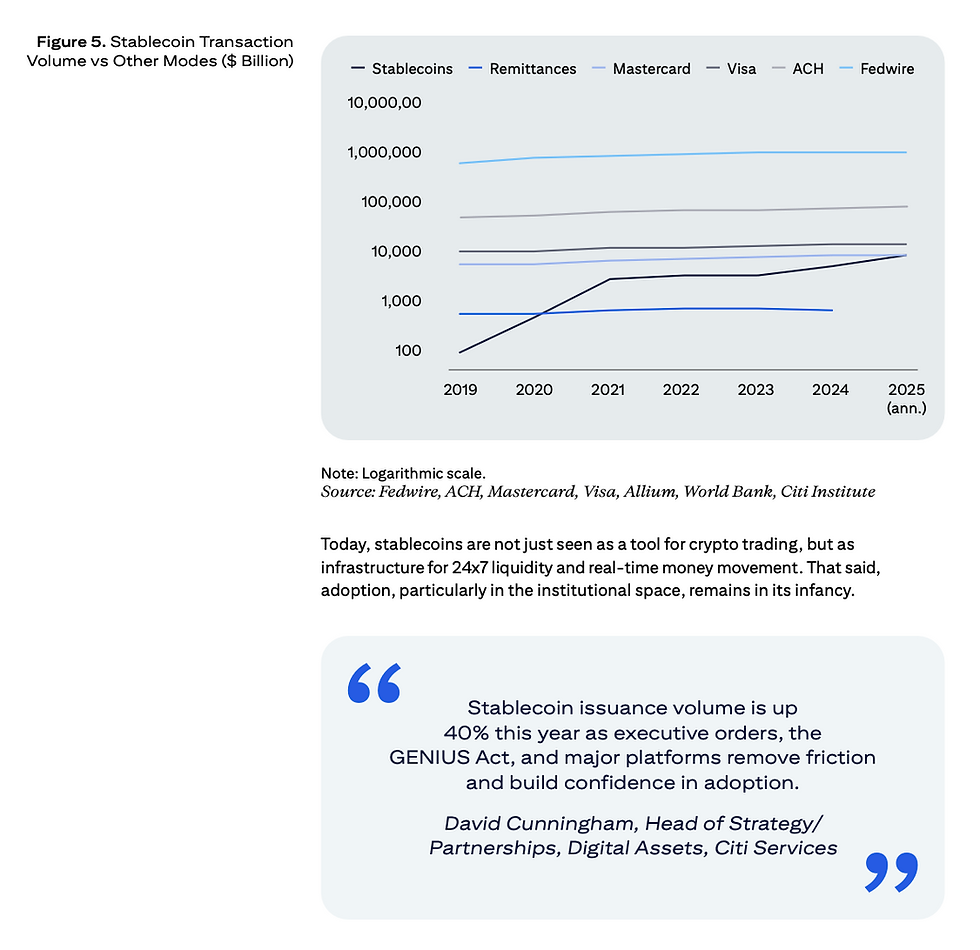

The report uses a powerful analogy, arguing that 2025 is poised to be "blockchain’s ChatGPT moment," with stablecoins igniting a transformation in institutional adoption. This claim is backed by impressive projections: a base case of $1.9 trillion in stablecoin issuance could support nearly $100 trillion in annual transaction activity by 2030.

But just as quickly, the analysis provides a dose of surprising context, stating that while these numbers sound enormous, they are "still small relative to money flows."

For perspective, the report notes that "leading banks move $5-10 trillion per day today." This isn't to diminish the "ChatGPT moment," but to frame it correctly: this is the beginning of a multi-decade integration, not an overnight replacement of the legacy system. This crucial takeaway grounds the excitement in reality, showing that while the growth is explosive, the on-chain world is still in the early innings of integrating into the vast scale of global finance.

A Smarter, Faster Future

The insights from Citi's report paint a picture of a financial future that is more complex and integrated than many narratives suggest. The key theme is not about a single technology replacing another, but about the co-existence and evolution of new and old financial rails.

As the report concludes, this is not a "digital format war" but "a continued progress towards smarter, faster finance." It leaves us with a critical question to ponder: As these new digital rails are built, will they ultimately connect to create a more unified global system, or will we see a future of powerful, competing financial ecosystems?

Disclaimer: This article is provided for information and educational purposes only and does not constitute investment advice, financial advice, or a recommendation to buy, sell, or hold any financial products or instruments. Past performance is not a reliable indicator of future results.

The views expressed are based on publicly available information, including Citi’s Stablecoins 2030 report, and may not reflect the latest market developments. Always conduct your own research or consult a qualified financial adviser before making investment decisions.

Alpesh Patel OBE www.campaignforamillion.com

Comments