The Hidden Tax of Financial Advice: Why 1% Fees Can Devour Your Profits

- Alpesh Patel

- Aug 23, 2025

- 3 min read

Updated: Aug 25, 2025

One percent doesn’t sound like much. We shrug at a supermarket surcharge or a tip at the café. But when it comes to your life savings, that innocent little “1% fee” levied by many independent financial advisers (IFAs) is not just a rounding error - it’s a financial black hole.

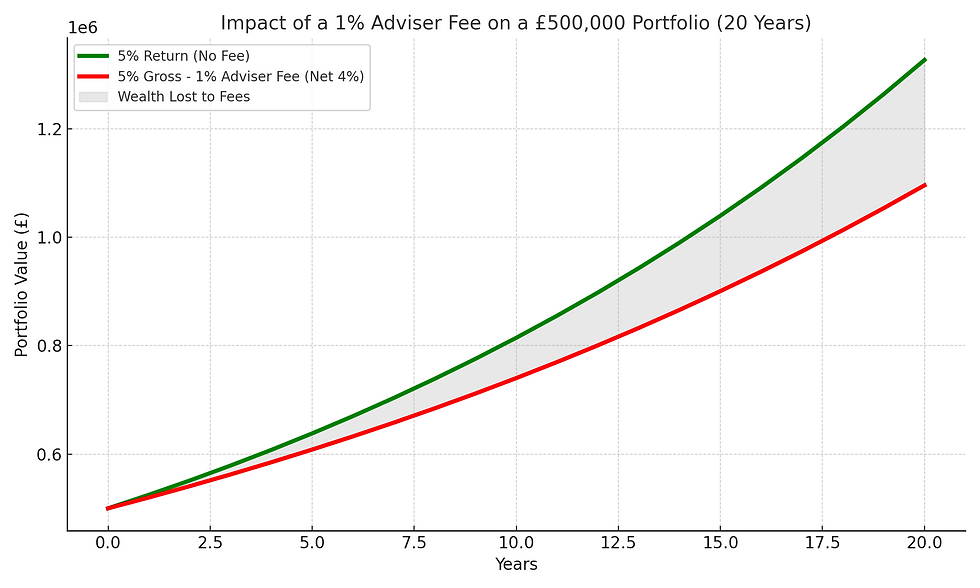

Let’s do the maths. An IFA promising you 5% annual returns while charging 1% for the privilege is effectively taking 20% of your profits - every single year. Forever. This is not wealth management; it’s wealth siphoning.

Imagine buying a house and the estate agent insists on keeping one-fifth of your rental income in perpetuity. You’d call that daylight robbery. Yet investors meekly sign away the same proportion of their financial future to IFAs. The illusion works because 1% feels small. But compound it over a 20-year retirement and it’s not small - it’s a yacht for your adviser and a smaller pension for you.

Take a portfolio of £500,000 earning 5% gross. With no adviser, you might net £25,000 a year before tax. With an adviser charging 1%, your return falls to £20,000. Over 20 years, that’s a six-figure difference.

And remember, the adviser pockets their fee even if your portfolio shrinks in a downturn. Heads they win, tails you lose.

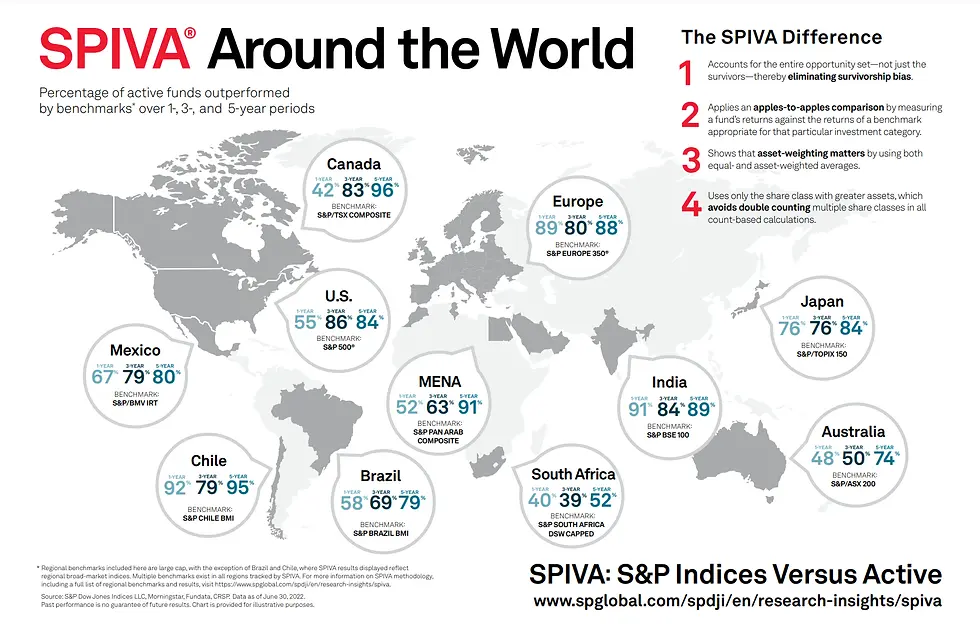

The dirty little secret of the investment industry is that most IFAs do not outperform the market. S&P’s SPIVA report shows that the majority of active fund managers underperform their benchmarks over time (S&P Dow Jones Indices, 2023).

Why pay someone a perpetual tax to underperform? It’s like hiring a chauffeur who drives slower than you would on your own.

This is why I created the Great Investments Programme. Instead of outsourcing responsibility - and paying through the nose for it - you learn how to invest smarter. You retain control, keep your returns, and avoid the corrosive effect of ongoing fees. Education, not endless rent-seeking, is the path to wealth.

The point isn’t that all advisers are bad. Some provide valuable planning services. But investors must recognise the cost of those services. A fee that looks “reasonable” in percentage terms can devastate your long-term wealth. Transparency is everything.

Next time an adviser tells you 1% is “modest,” ask yourself: would you happily hand over 20% of your profits for life to someone who may not even beat the market? If the answer is no, you already know what to do.

Disclaimer:This article is for educational purposes only and reflects general investment principles. It does not constitute financial advice, investment advice, or a personal recommendation, and should not be relied upon to make investment decisions.

Investments can go down as well as up, and you may not get back the capital you invest. Past performance is not a reliable indicator of future results. Examples, figures, or case studies used are illustrative only and do not represent actual or guaranteed returns.

Any references to third-party data (such as the SPIVA report) are provided for context, and while believed to be accurate at the time of writing, no warranty is given as to their completeness or reliability.

If you are unsure about the suitability of any investment for your circumstances, you should seek advice from a regulated financial adviser authorised by the Financial Conduct Authority (FCA).

Alpesh B Patel

www.campaignforamillion.com

Comments