What if The USA is Overvalued?

- Alpesh Patel

- Sep 9, 2025

- 2 min read

Updated: Sep 25, 2025

You’re right to worry about expensive assets. By classic yardsticks the US looks rich. The Shiller CAPE sits in the high 30s, historically elevated.

MSCI’s August 2025 factsheet shows the MSCI USA on a forward P/E ~22.8. Meanwhile, MSCI ACWI ex USA trades nearer ~14.6 forward earnings - a sizeable discount.

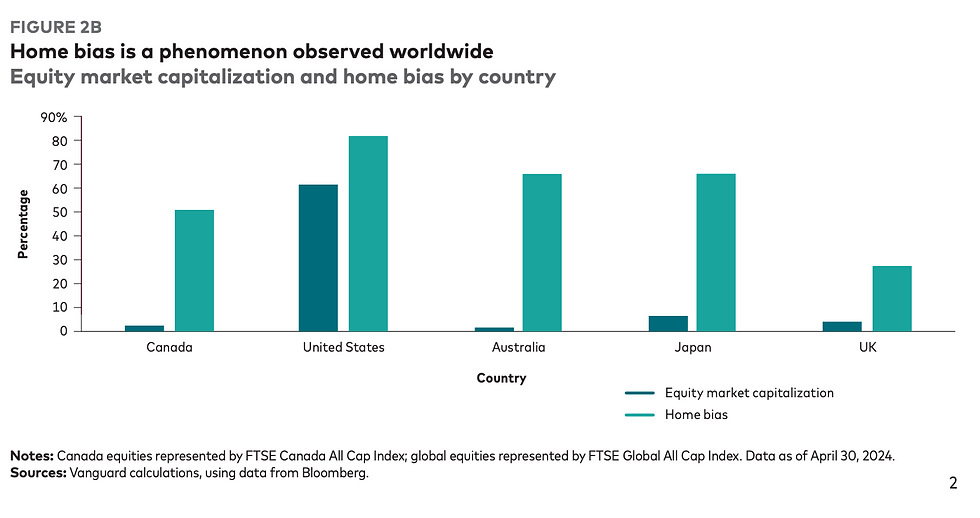

Expensive doesn’t mean “crash tomorrow,” but concentration plus high multiples should nudge rational investors toward global diversification and valuation discipline. Vanguard’s research on home-bias and global equity diversification is clear: home-bias is costly and diversification is your only free lunch in finance.

“Fine,” you say, “so when do we rotate?” Here’s the awkward truth: timing valuation spreads reliably is hard. AQR’s work shows factor timing and market timing add little on average - big spreads can persist longer than your patience. The saner response is structural - own the world, tilt toward reasonably priced quality and value, and rebalance instead of gambling on a date with destiny. For instance, MSCI USA Value sits at a lower forward P/E than broad USA, while ACWI ex USA Value is cheaper still.

GIP’s approach reflects that evidence: reduce single-country risk, favour sensible valuations, and use rebalancing rules to harvest volatility. If US leadership endures, you still own it. If leadership rotates, you’re already there. Either way, you stop betting the farm on one postcode.

Sources: Shiller CAPE: https://www.multpl.com/shiller-pe

MSCI ACWI ex USA: https://www.msci.com/indexes/index/899901

MSCI ACWI ex USA Value: https://www.msci.com/www/fact-sheet/msci-acwi-ex-usa-value-index/08820850

Vanguard global diversification: https://www.vanguard.ca/content/dam/intl/americas/canada/en/documents/HOBI_052024_V14_secure.pdf

Disclaimer:

This article is provided for educational and informational purposes only. It does not constitute investment advice, an offer, or a solicitation to buy or sell any security, fund, or financial product. Past performance is not a reliable indicator of future results. Investing involves risks, including the potential loss of capital. You should consider your own financial circumstances and consult with a qualified financial adviser before making any investment decisions. Alpesh B Patel OBE www.campaignforamillion.com

Comments