OECD Economic Outlook 3 Surprising Economic Shifts Hiding in Plain Sight

- Alpesh Patel

- Sep 29, 2025

- 4 min read

Navigating the daily flood of economic news can feel overwhelming. Beyond the day-to-day chatter of inflation prints and interest rate speculation, it’s easy to miss the deeper currents shaping our financial future.

That's why, when the Organisation for Economic Co-operation and Development (OECD) releases its comprehensive "Economic Outlook," it's time to pay attention.

The latest report cuts through the noise to unearth foundational shifts quietly reshaping our economic reality. While many will focus on the headline growth projections, the real story is in the details - revealing an economy pulled between the policies of the past and the technologies of the future.

This post distills the three most impactful takeaways from the OECD's analysis. These are not just fleeting trends but significant developments with long-term consequences for businesses, consumers, and policymakers - shifts that everyone should be aware of.

The Three Key Takeaways

1. We're Experiencing a Trade War Flashback to the 1930s

The recent surge in US trade tariffs is not just a policy shift; it's a step into an economic time machine, dialling trade policy back nearly a century. According to the OECD, the overall effective US tariff rate has risen to an estimated 19.5% as of August 2025.

The report puts this in stark historical context, noting it is "the highest rate since 1933."

To make that abstract number concrete, the report notes that US tariffs on all steel and aluminium imports have been raised by an additional 25 percentage points, and tariffs on all copper imports by a staggering 50 percentage points.

Initially, global growth seemed surprisingly resilient. The report attributes this to "front-loading," a phenomenon where companies rushed production and accelerated trade to get ahead of the impending tariffs.

This created a temporary, and somewhat misleading, buffer for the global economy. Now, that buffer is gone. The OECD warns that the full negative effects are becoming "increasingly visible in spending choices, labour markets and consumer prices."

2. Crypto Isn't Just a Sideshow Anymore - It's a Systemic Risk

While one part of the global economy is wrestling with ghosts of the past, another is grappling with a volatile and entirely new financial frontier.

For the first time, one of the world's most methodical economic bodies is officially moving crypto from the "speculative curiosity" column to the "systemic financial risk" ledger. This is a watershed moment.

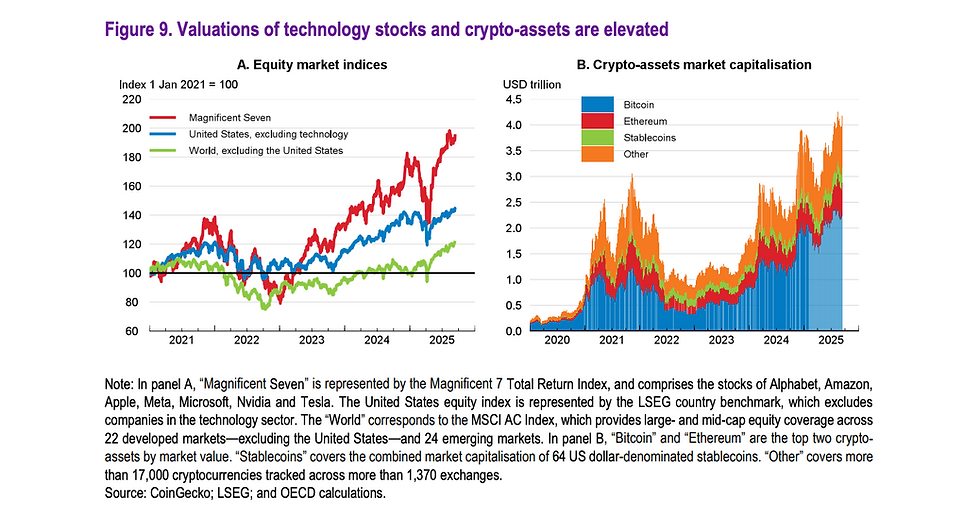

The scale is staggering. The OECD notes that crypto-asset market capitalization surged from USD 830 billion in January 2023 to a record-high USD 3.9 trillion by September 2025.

But the real concern isn't just price swings; it's crypto's "growing interconnectedness with the traditional financial system." The report explains how this is happening, pointing to "the expansion of crypto exchange-traded products and recent regulatory developments" that are building bridges between these two worlds.

For example, stablecoins are often backed by traditional assets like sovereign bonds. A crisis of confidence in a major stablecoin could trigger a fire sale of those bonds, sending shockwaves through the entire financial system.

As the OECD states directly: The high price volatility of crypto-assets and their growing interconnectedness with the traditional financial system also raises financial stability risks.

3. Global Growth Is Slowing Down, But AI Could Be Our Economic Lifeline

The report presents a sobering long-term forecast. Looking beyond the immediate future, the OECD projects that "global annual potential output growth is projected to moderate to 2¾ per cent in the first part of the 2030s and 2¼ per cent in the early 2040s."

This slowdown is driven by powerful headwinds, including demographic shifts and the consequences of weak capital investment.

However, the report also outlines a powerful, two-step counter-narrative. First, it finds that ambitious structural policies - like reducing regulatory barriers and boosting female employment - could on their own lift long-term growth. But the real game-changer is the rapid adoption of artificial intelligence.

The OECD quantifies this potential lifeline. Adding a "faster AI adoption" scenario on top of structural reforms could raise average annual GDP growth by an "additional 0.4 percentage points in advanced G20 economies and 0.3 percentage points in emerging-market G20 economies by 2050."

This presents our economic future not as a simple choice between stagnation and prosperity, but as a series of crucial decisions that could compound to unlock a much brighter outlook.

A Final Thought

The latest OECD data reveals an economy at a crossroads, defined by the resurgence of historical tariffs, the emergence of new systemic risks from crypto-assets, and the urgent need to harness AI to secure future growth.

As we navigate a world defined by 1930s-era trade policies and 21st-century technology, which force do you believe will ultimately shape our economic future?

Disclaimer: This article is based on publicly available data from the OECD Interim Economic Outlook and other cited sources. It is intended solely for informational and educational purposes and does not constitute financial, investment, or professional advice.

Readers should not rely solely on this content when making financial decisions. Economic conditions and projections are subject to change, and past performance is not indicative of future results. Please consult a qualified financial advisor before making any investment or policy decisions.

Alpesh Patel OBE www.campaignforamillion.com

Comments